forover-18.site Prices

Prices

What Bed Is Better For Back Pain

:max_bytes(150000):strip_icc()/Mattresses-for-Back-Pain-PEO-tout-d9547f04a38e4ab79440cdfb2fd0e99d.jpg)

Selecting the best bed for lower back pain involves considering factors such as mattress firmness and support. Memory foam or medium-firm. Turmerry mattresses are designed to provide the utmost comfort and support, which is essential for sleepers with back pain. We Recommend: Sanctuary Orthopaedic Mattress It has long been thought that orthopaedic mattresses are the best solution for a bad back as they are. In my opinion, latex mattresses offer the best support. 3. Pressure Relief. If you suffer from shoulder or hip pain, or are a side sleeper then pressure relief. The best mattress for back pain isn't just about going firm or soft; it's about finding the right balance that supports your spine while cradling your pressure. Back pain, often worsening quality of sleep, can in turn aggravate stress and anxiety. And, in turn, worry can lead to physical pain. For our top pick for lower back pain, we specifically recommend the Helix Dusk Luxe, as its medium firmness works for a lot of different sleepers. When lying. The best mattress we usually recommend for a bad back is of medium-firm density. While it is important not to have an overly firm mattress for back pain. Back pain can make sleeping a challenge. Finding the best mattresses for back pain relief can make all the difference. Check out our top 10 picks! Selecting the best bed for lower back pain involves considering factors such as mattress firmness and support. Memory foam or medium-firm. Turmerry mattresses are designed to provide the utmost comfort and support, which is essential for sleepers with back pain. We Recommend: Sanctuary Orthopaedic Mattress It has long been thought that orthopaedic mattresses are the best solution for a bad back as they are. In my opinion, latex mattresses offer the best support. 3. Pressure Relief. If you suffer from shoulder or hip pain, or are a side sleeper then pressure relief. The best mattress for back pain isn't just about going firm or soft; it's about finding the right balance that supports your spine while cradling your pressure. Back pain, often worsening quality of sleep, can in turn aggravate stress and anxiety. And, in turn, worry can lead to physical pain. For our top pick for lower back pain, we specifically recommend the Helix Dusk Luxe, as its medium firmness works for a lot of different sleepers. When lying. The best mattress we usually recommend for a bad back is of medium-firm density. While it is important not to have an overly firm mattress for back pain. Back pain can make sleeping a challenge. Finding the best mattresses for back pain relief can make all the difference. Check out our top 10 picks!

Consider different factors when shopping for beds, such as the firmness, sleeping position, zoned support, mattress type, comfort level, the price and return. In this article, we will learn how to choose the right mattress for comfort and long-term freedom from back-pain. Sleeping in a reclined position can significantly alleviate lower back pain by reducing pressure on the spine. Adjustable beds or specially designed wedges are. Instead, people with back pain should look for mattresses that feel medium-firm to you. Those beds have the best chance of reducing both soreness and stiffness. A medium to medium-firm bed (between a 5 and 7 out of 10 on our firmness scale) is typically best for most sleepers with back pain. It should have the right. There is no actual “best” mattress for back-pain sufferers, though one that feels medium-firm to you is likely to be the best choice. In this article, we will learn how to choose the right mattress for comfort and long-term freedom from back-pain. Sleeping in a reclined position can significantly alleviate lower back pain by reducing pressure on the spine. Adjustable beds or specially designed wedges are. Which mattress firmness is best? For chronic back pain, studies show that reduction in symptoms and improved quality of sleep can be achieved by sleeping on a. The Layla Mattress is the best bed for back pain and perfect sleep because it offers flippable firmness to let you choose soft or firm depending on your. The WinkBed is our top pick for those with back pain. When we tested it in our lab, we felt its hybrid construction was ideal for supporting individuals in all. The best mattress for back pain isn't just about going firm or soft; it's about finding the right balance that supports your spine while cradling your pressure. In this blog, we'll delve into the fascinating and often overlooked connection between mattresses and back pain. DreamCloud was named a Best Mattress for Back Pain by Mattress Nerd in happy sleeper. 1 Million Happy Sleepers. With 38,+ 5-star reviews and 1 million. What type of mattress is best for reducing back pain? · Soft mattresses. Tend to conform to your shape but fail to deliver uniform support across the entire body. The Layla Mattress is the best bed for back pain and perfect sleep because it offers flippable firmness to let you choose soft or firm depending on your. Sleeping in zero gravity position evenly distributes the body weight and reduces lower back pain. Get the best adjustable bed for back pain from Zero-G Beds. The best type of mattress for avoiding lower back lumbar pain varies based on individual preferences. Memory foam and medium-firm mattresses are. EGOHOME 12 Inch Queen Mattress, Copper Gel Cooling Memory Foam Mattress for Back Pain Relief,Therapeutic Double Matress Bed in a Box, CertiPUR-US Certified. Selecting the best bed for lower back pain involves considering factors such as mattress firmness and support. Memory foam or medium-firm.

Investment Portfolio Loan

A portfolio lender is a bank or other financial institution that originates mortgage loans and then keeps the debt in a portfolio of loans. portfolio programs, we service your mortgage payment for the life of your loan. Finance a second home or investment property with resort-like amenities. A portfolio loan is a loan that a lender will keep in their portfolio, instead of selling to the secondary market. A primary reason that these lenders keep the. Arbor provides single-family rental (SFR) portfolio investors with an array of short-term and long-term financing options to fit their investment strategies. A portfolio loan mortgage allows landlords to put all their Buy to Let properties under one mortgage, which is then managed as one account with one monthly. We have developed Portfolio Loan options to meet the needs of borrowers that traditional mortgages may leave behind. From higher loan amounts to more credit. Read about three asset-backed lending solutions—HELOC, margin, and securities-based lines of credit—and under what circumstances you might consider using. The loan is secured against the value of a discretionary portfolio managed by Investec Wealth & Investment (IW&I) which may include general investment accounts. Streamline 5+ properties into one loan with ease. Partner with trusted experts to craft a rental portfolio loan as unique as your investment strategy. A portfolio lender is a bank or other financial institution that originates mortgage loans and then keeps the debt in a portfolio of loans. portfolio programs, we service your mortgage payment for the life of your loan. Finance a second home or investment property with resort-like amenities. A portfolio loan is a loan that a lender will keep in their portfolio, instead of selling to the secondary market. A primary reason that these lenders keep the. Arbor provides single-family rental (SFR) portfolio investors with an array of short-term and long-term financing options to fit their investment strategies. A portfolio loan mortgage allows landlords to put all their Buy to Let properties under one mortgage, which is then managed as one account with one monthly. We have developed Portfolio Loan options to meet the needs of borrowers that traditional mortgages may leave behind. From higher loan amounts to more credit. Read about three asset-backed lending solutions—HELOC, margin, and securities-based lines of credit—and under what circumstances you might consider using. The loan is secured against the value of a discretionary portfolio managed by Investec Wealth & Investment (IW&I) which may include general investment accounts. Streamline 5+ properties into one loan with ease. Partner with trusted experts to craft a rental portfolio loan as unique as your investment strategy.

Our Portfolio Loans are designed to offer a swift, flexible and cost-efficient way to borrow against your investments. Borrowing money against the value of your investment portfolio can be a convenient and flexible way to fund other opportunities. Financial flexibility · Securities-based loans defined · Borrowing against investments is not without risks · Wells Fargo Bank Priority Credit Line · Wells Fargo. Our Portfolio Rental Loan is designed to help rental investors unlock equity and get cash out of their existing rental investments. A portfolio loan is a type of loan that is typically used by investors or borrowers with specific needs that cannot be met by conventional loans. portfolio. Our time-tested experience and partnerships with real estate investors, developers, and builders allow us to deliver value to our clients. Start. investment opportunity. Using a line of credit allows you to remain invested and keep your investment portfolio intact. Other common uses include: Real. Strategize how you borrow while staying invested. Margin Loans from Charles Schwab & Co., Inc. Borrow against your portfolio to buy securities or for quick. Unlock the potential of your investment portfolio to meet your borrowing needs. See how you can use your assets as collateral for easy access to cash. As an established alternative investment fund manager, AB CarVal seeks investments on behalf of its distressed debt funds in portfolios of loans sold by banks. What is a Portfolio Line of Credit? A Portfolio Line of Credit is a margin loan (otherwise known as a securities-backed line of credit), which essentially. financial year. Other credit and lending criteria also apply. Can I transfer my portfolio or existing portfolio loan to Investec Wealth & Investment? Portfolio loans are a financing option offered by real estate lenders that allow an investor to merge the mortgages of multiple properties into a single monthly. A portfolio of single-family homes in the U.S. has been one of the most popular real estate investments globally. However, lack of financing options have made. If you own 5+ Rental Properties, CoreVest may be able to finance up to 75% value of your next rental portfolio loan Loans are for investment purposes only and. Hi all, Many times we see here and there that "rich people" use their portfolios to get loans for other kind of investments. The purpose of portfolio financing can be to consolidate existing debt. It can also be used to get cash out of the investment property portfolio. Some of the. Another advantage to borrowing against a portfolio is there's no formal credit application, as there is with a mortgage for example, and the loan can be. Portfolio loans sound like a boutique product for elite investors, however they are simply another loan that a lender keeps in their investment portfolio. The word portfolio indicates that the loan is held in the portfolio of a private investor, in their investment portfolio. Because a portfolio loan is being.

Closing Costs On 80k Home

In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. closing unless under our new build/construction programs for newly manufactured home models. down that Consumer's applicable closing costs. In no event shall. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. As part of this relaunch, eligible homebuyers may receive up to $80, for down payment and closing costs assistance. Home Mortgage Alliance. Darlene. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Estimate of all other closing costs for this loan. This should include What house can I afford on 80k a year? With an income of 80k a year, you can. Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property location, and include costs such. Down Payment + Closing Costs, $, Loan Amount, $, Monthly Payment However, home-buyers must pay an upfront mortgage insurance premium at closing. Use our closing cost estimator to calculate the closing costs on your mortgage. Get the estimates & info you need with our closing cost calculator. In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. closing unless under our new build/construction programs for newly manufactured home models. down that Consumer's applicable closing costs. In no event shall. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. As part of this relaunch, eligible homebuyers may receive up to $80, for down payment and closing costs assistance. Home Mortgage Alliance. Darlene. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Estimate of all other closing costs for this loan. This should include What house can I afford on 80k a year? With an income of 80k a year, you can. Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property location, and include costs such. Down Payment + Closing Costs, $, Loan Amount, $, Monthly Payment However, home-buyers must pay an upfront mortgage insurance premium at closing. Use our closing cost estimator to calculate the closing costs on your mortgage. Get the estimates & info you need with our closing cost calculator.

Closing Costs: Closing costs can be negotiated between the buyer and seller. Down payment: $15, (5%); Closing costs: $9, (3%); Total cash needed: $24, First-time home buyers are often taken by surprise when they learn how. This closing costs calculator estimates the upfront costs associated with most home purchases, including legal, appraisal and land transfer fees. Closing costs generally account for % of the home purchase price. Among the costs, below are a list of the most common to keep an eye out for and budget. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. Closing costs are typically about % of your loan amount and are usually paid at closing. What is included in closing costs? While each loan situation is. Closing Costs. -. Year, Beginning Balance, Total Payment, Principal, Interest, Ending The total cost of home ownership is more than just mortgage payments. Our lender is telling us to expect up to 5% (so 25k on a $k house) that is a whole additional downpayment?! What did everyone pay? Closing Costs. $3, Seller Concessions. $5, Other Costs to Consider Why does it cost money to sell my home? Selling a home is a complicated. Real estate is one of the most illiquid assets, so there is usually a cost associated with tapping into your home equity. If you actually sell the house, total. Our closing cost calculator estimates your total closing costs if you are buying a house. Closing costs are usually 2% - 5% of the loan amount. House was $k. Closing costs were about $k. We bought some points down though, along with using and FHA loan. As others in this thread. We considered all applicable closing costs, including the mortgage tax, transfer tax and both fixed and variable fees. Once we calculated the typical closing. Down payment calculator · How much house can I afford calculator · Closing costs calculator · Cost of living calculator · Mortgage amortization calculator. closing costs and net proceeds will be when selling your home. It should be Some of these include paying off your mortgage, real estate agent fees, and. Closing Cost Calculator A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into. Cost Comparison Over Time ; Closing Costs, -$31, ; Capital Gains Tax, $0 ; Proceeds From Home Sale, $, ; Tax Savings, $49, VA Home Loans · Homeowners Insurance · Closing Costs · Down Payments · Getting a HELOC. Mortgage Calculators. Mortgage Calculators · VA Mortgage Calculator. Your total estimated refinancing costs will be: $6, · Loan Info · Choose a term length · Taxes & Insurance · Origination Fees · Other Settlement Services. The closing costs on a small mortgage may add up to a higher percentage of the loan amount than is typical for mortgages in general. A common rule of thumb is.

What Is The Yield Of An Etf

The iShares Year High Yield Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield. The Distribution rate and Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may. The dividend yield is calculated by dividing the most recent dividend payment by the price of the fund. For our purposes, we are using the latest closing price. The Harbor Scientific Alpha High-Yield ETF (SIHY) is an actively managed fixed income strategy that seeks total return through employing a structured. Vanguard International High Dividend Yield ETF (VYMI) - Find objective, share price, performance, expense ratio, holding, and risk details. HYD - Overview, Holdings & Performance. The ETF is a high-yield muni focus whose underlying index is comprised of the highest-yielding municipal bonds. High Dividend Yield Index Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks. The yields are calculated as follows: US Equity: S&P trailing twelve month yield; Global REITs: FTSE NAREIT Global REITs; U.S. High Yield: Bloomberg U.S. The ACF Yield is the discount rate that equates the ETF's aggregate cash flows (i.e., the sum of the cash flows of the ETF's holdings) to a given ETF price. The iShares Year High Yield Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield. The Distribution rate and Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may. The dividend yield is calculated by dividing the most recent dividend payment by the price of the fund. For our purposes, we are using the latest closing price. The Harbor Scientific Alpha High-Yield ETF (SIHY) is an actively managed fixed income strategy that seeks total return through employing a structured. Vanguard International High Dividend Yield ETF (VYMI) - Find objective, share price, performance, expense ratio, holding, and risk details. HYD - Overview, Holdings & Performance. The ETF is a high-yield muni focus whose underlying index is comprised of the highest-yielding municipal bonds. High Dividend Yield Index Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks. The yields are calculated as follows: US Equity: S&P trailing twelve month yield; Global REITs: FTSE NAREIT Global REITs; U.S. High Yield: Bloomberg U.S. The ACF Yield is the discount rate that equates the ETF's aggregate cash flows (i.e., the sum of the cash flows of the ETF's holdings) to a given ETF price.

Jacob designed the investment process for the FI Yield Funds and contributed to the creation of many of these vehicles. He focuses on portfolio construction. BMO Premium Yield ETF ZPAY seeks to provide exposure to a portfolio of U.S. large capitalization companies, by investing in U.S. equity securities and. JPMorgan Income ETF ; YTD · 09/13/ at NAV% ; 30 DAY SEC YIELD · 08/31/ %. Unsub% ; YIELD TO MATURITY · 07/31/ Gross%. Net%. Vanguard International High Dividend Yield ETF (VYMI) - Find objective, share price, performance, expense ratio, holding, and risk details. The SEC yield is a standard yield calculation developed by the US Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. FUND OVERVIEW · DISTRIBUTIONS. Monthly · YIELD. % based on NAV · CUSIP. L · EXCHANGE. Toronto Stock Exchange. Most viewed exchange-traded funds · Nuveen ESG International Developed Markets Equity · Nuveen Enhanced Yield U.S. Aggregate Bond · Nuveen ESG Large-Cap Growth. PGIM Ultra Short Bond ETF is an actively managed ultra-short bond ETF that offers a competitive yield and expenses. Find investment performance and objectives for the T. Rowe Price QM U.S. Bond ETF (TAGG). Cambria Emerging Shareholder Yield ETF focuses on companies in emerging market countries that are returning cash to shareholders through three attributes -. In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange. YieldMax™ ETFs seek to generate monthly income by pursuing options-based strategies on one or more underlying securities. YieldMax™ ETFs aim to harvest. The 1-Day Yield is an annualized net yield for the day listed. It is Government Funds: You could lose money by investing in the Fund. Although. An actively managed ETF that aims to provide high current income and risk-adjusted returns by investing in BB and B-rated debt issues and yield-oriented. Xtrackers USD High Yield Corporate Bond ETF · Asset class. Fixed Income · Region. USA · Investment style. Passive · day SEC yield. % · Distribution yield. The distribution yield of a security is calculated by dividing the distributions paid (yearly, monthly, etc.) by its cost or net asset value. Distribution yield. Eaton Vance High Yield ETF (EVHY) Diversification does not eliminate risk of loss. There is no assurance that a portfolio will achieve its investment objective. These ETFs (exchange-traded funds) typically hold stocks that have a history of distributing dividends to their shareholders. All YieldMax™ ETFs have a gross expense ratio of %. Distributions are not guaranteed. **The Distribution Rate and Day SEC Yield is not indicative of. Find latest pricing, performance, portfolio and fund documents for Putnam ESG High Yield ETF - PHYD.

Best Credit Cards For Flying Rewards

Travel credit cards ; Chase Sapphire Preferred® Card · reviews · 1x - 5x ; Capital One Venture Rewards Credit Card · 69 reviews · 2x - 5x ; Capital One Quicksilver. Types of air miles credit cards These are specialist credit cards that are linked to specific airline rewards points schemes. For example: British Airways. If you want a free card with flexibility Rogers World Elite is pretty good. % cash back so you can use it for anything including flights. Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two ; Top cards for. Explore travel credit cards from Wells Fargo. Review the travel reward benefits that fit your lifestyle. Find the best travel card for you and apply today. The CIBC Aeroplan Visa Infinite is our top pick for the best travel card thanks to the huge amount of Air Canada benefits it provides. Maple Leaf Lounge access. Compare the best CIBC travel rewards credit cards and earn points when you travel for business or holiday. Use your card in Canada or abroad. We've ranked the best credit card offers below with an eye toward those that can help you book luxury travel. Mastercard® Titanium Card™ Designed for those seeking an introductory premium travel card with exceptional airfare redemption, access to hotel privileges, and. Travel credit cards ; Chase Sapphire Preferred® Card · reviews · 1x - 5x ; Capital One Venture Rewards Credit Card · 69 reviews · 2x - 5x ; Capital One Quicksilver. Types of air miles credit cards These are specialist credit cards that are linked to specific airline rewards points schemes. For example: British Airways. If you want a free card with flexibility Rogers World Elite is pretty good. % cash back so you can use it for anything including flights. Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two ; Top cards for. Explore travel credit cards from Wells Fargo. Review the travel reward benefits that fit your lifestyle. Find the best travel card for you and apply today. The CIBC Aeroplan Visa Infinite is our top pick for the best travel card thanks to the huge amount of Air Canada benefits it provides. Maple Leaf Lounge access. Compare the best CIBC travel rewards credit cards and earn points when you travel for business or holiday. Use your card in Canada or abroad. We've ranked the best credit card offers below with an eye toward those that can help you book luxury travel. Mastercard® Titanium Card™ Designed for those seeking an introductory premium travel card with exceptional airfare redemption, access to hotel privileges, and.

Credit Cards. Card Type. Top Travel CardsElevated OffersBusiness$95 Annual 2) Capital One Venture X Rewards Credit Card. Best for premium travel perks. The best cards in the Canadian credit card market currently appear to be Fixed Value Rewards cards, but are often touted as Travel Points cards. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. AAdvantage® credit cards ; Special offer: Earn 75, bonus miles. Terms apply. · Citi® / AAdvantage® Platinum Select® World Elite Mastercard® ; Earn 15, bonus. TD Travel Rewards Credit Cards are designed to help you achieve travel goals sooner by earning Rewards Points on everyday purchases. Delta SkyMiles® American Express Cards · Delta SkyMiles® Gold American Express Card. EARN 40, BONUS MILES · DELTA SKYMILES® PLATINUM AMERICAN EXPRESS CARD. You can't go wrong beginning your travel-rewards journey with any Chase credit card that earns Ultimate Rewards points. The Chase Sapphire Preferred card is an. If you want to look exclusively at the best airline rewards programs, Delta SkyMiles, Alaska Airlines AAdvantage points and Southwest Rapid Rewards. $0 Intro Annual Fee, $99 after the first year. · First checked bag free on American Airlines domestic itineraries · No foreign transaction fees · No limit on. And, the Discover it® Miles card is a rewards credit card that gives you points for travel expenses and every other purchase you make with your card. So it can. Chase Sapphire Reserve® is widely regarded as the best premium travel credit card on the market. The annual fee is steep, but the benefits of this card are. Airline Credit Cards ; United Explorer Card · Earn 50, bonus miles · $0 intro annual fee for the first year, then $95 ; United Quest Card · Earn 60, bonus. This guide reviews the main types of travel reward credit cards as well as five things to consider when choosing the one (or two or three) for your wallet. While some other premium rewards credit cards limit the use of their travel credits to incidental costs like checked bag fees, the Chase Sapphire Reserve®. Travel rewards credit cards are simply credit cards that allow cardholders to earn travel points for all purchases made. Travel Rewards Cards (12) · American Express Gold Card · Annual Fee: $ · Annual Fee: $ · The Platinum Card · Annual Fee: $ · Annual Fee: $ · American. Best gas credit cards for bad credit. You may find most rewards cards for bad credit are ones geared to specific purchases, such as gas. 4 min read Aug. The Chase Sapphire Reserve stands out as a top choice for flexible airline rewards. It packs a punch with impressive, premium benefits like a $ yearly travel. Best flat-rate airline card: Capital One Venture Rewards Credit Card. Capital One Venture Rewards Credit Card offers a competitive, flat reward rewards rate. Without question, the American Express Cobalt Card is the best travel credit card in Canada. With earn rates reaching as high as 10%, the ability to.

How Long Does Bankruptcy Affect You

How Long Does Bankruptcy in Florida Affect Your Credit? Yes, bankruptcies are recorded on your credit report. Depending on the type of bankruptcy case, it can. Bankruptcy may affect your income, employment and business. If you earn over a set amount, you may need to make compulsory payments to your trustee. There may. Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. The official receiver has 3 years to take action in relation to your home, this means it won't be affected by your discharge. Your share in your home will. A bankruptcy filing may stay on your credit report for up to ten years, but there are ways to help build up your credit score even with the filing on your. Your bankruptcy is a public record that can stay on your credit report for up to ten (10) years from the date you filed your case (not the discharge date). Some. You can typically work to improve your credit score over months after bankruptcy. Most people will see some improvement after one year if they take. It will remain on there for 7 or 10 years depending upon which chapter you file. For the immediate future it could affect you anytime some. It can result in your losing a great deal of your personal assets to repay what you owe, as well as negatively affecting your credit score for up to a decade. How Long Does Bankruptcy in Florida Affect Your Credit? Yes, bankruptcies are recorded on your credit report. Depending on the type of bankruptcy case, it can. Bankruptcy may affect your income, employment and business. If you earn over a set amount, you may need to make compulsory payments to your trustee. There may. Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. The official receiver has 3 years to take action in relation to your home, this means it won't be affected by your discharge. Your share in your home will. A bankruptcy filing may stay on your credit report for up to ten years, but there are ways to help build up your credit score even with the filing on your. Your bankruptcy is a public record that can stay on your credit report for up to ten (10) years from the date you filed your case (not the discharge date). Some. You can typically work to improve your credit score over months after bankruptcy. Most people will see some improvement after one year if they take. It will remain on there for 7 or 10 years depending upon which chapter you file. For the immediate future it could affect you anytime some. It can result in your losing a great deal of your personal assets to repay what you owe, as well as negatively affecting your credit score for up to a decade.

A first bankruptcy will remain on your credit report for six years after discharge. This is extended to 14 years for a second bankruptcy. Instead, you are allowed to retain your assets, and the courts discharge all your qualifying debts. Find Out If You Qualify to File Bankruptcy. When debt. Bankruptcy stays on your credit file for at least six years. This can make it hard to get credit, loans or a mortgage. Chapter 7 will discharge (eliminate) most or all consumer debts so they do not have to be paid. Chapter 7 is over in a few months and you can begin rebuilding. All of the individual accounts included in the bankruptcy should be removed from your credit report after 7 years. A bankruptcy is going to be factored into your FICO score until it falls off of your credit report. While it may take up to ten years for a bankruptcy to fall. Within about two years, your credit rating will begin to climb back up, and the bankruptcy itself will be less of a factor in your credit score than your credit. How long will bankruptcy stay on my credit report? If you file for bankruptcy, it will appear on your credit report for up to ten years for Chapter 7 and. Most negative information generally stays on credit reports for 7 years; Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the. After bankruptcy, individuals can improve their credit scores within months by adhering to budgets, making timely payments, and opening new accounts. Under the Fair Credit Reporting Act, your bankruptcy will appear on your credit report for ten years. Any of the accounts which are discharged through. Bankruptcy stays on your credit report for years depending on which bankruptcy you file. Learn how long each type of bankruptcy affects your credit. If a second bankruptcy is filed, then the first re-appears on your Equifax credit report, and both bankruptcies remain for 14 years after the discharge dates.”. If the debtor's current monthly income is less than the applicable state median, the plan will be for three years unless the court approves a longer period "for. How Long Does Bankruptcy Remain on My Credit Report? The length of time that a bankruptcy filing remains on your credit report depends on the chapter you file. The time limit is generally six years from discharge from bankruptcy, however there may be variations depending on your circumstances. Contact your trustee for. Bankruptcy will stay on your credit report for seven to ten years, depending upon how you file. And as long as it remains, it will affect your credit score. Bankruptcy stays on your credit report, but the duration varies: 10 years for Chapter 7 and seven years for Chapter Expect a significant impact on. While bankruptcy can give you a fresh start when it comes to your finances, it will remain on your credit report from seven to 10 years. Bankruptcy can raise your car insurance rates. It might seem unfair that you have to pay higher car insurance rates when you've fallen on hard times, but.

How Can I Sell My Own Home

What Are the Benefits of Selling Your House On Your Own? The primary reason that people choose to sell their house without a realtor is usually to save money. Homepie makes it easy to sell your own home. ; Protection. Digital Purchase Contract. Seller E&O Protection Plan ; Pro tools. Listing on MLS, Zillow. Offer. Option 1: Sell Your Home Yourself (FSBO) · Step 1. Calculate the value of your home · Step 2. Advertise and list your home · Step 3. Cleaning, repairs, and. 1. Determine the Right Price for Your Home Based on Market Conditions · 2. Get Your House Ready for Sale · 3. Promote, Promote, Promote! · 4. Negotiate with Buyers. Picket Fence has empowered consumers with the knowledge and tools to buy and sell real estate without agents, and their outrageous commissions for decades. Browse exclusive homes for sale by owner or sell your home FSBO. forover-18.site helps you sell your home fast and save money. The first would be selling For Sale By Owner (FSBO). You may try using yard signs, Craigslist, and other internet sites like Zillow or forover-18.site They negotiate the price on your behalf. Their facilitations ensure that you get the best profitable deal from the sale of your home. Doing it on your own. FSBO homes typically sell for about 24% less than those listed with agents, which may outweigh the money you save doing it all on your own.[1] While you're not. What Are the Benefits of Selling Your House On Your Own? The primary reason that people choose to sell their house without a realtor is usually to save money. Homepie makes it easy to sell your own home. ; Protection. Digital Purchase Contract. Seller E&O Protection Plan ; Pro tools. Listing on MLS, Zillow. Offer. Option 1: Sell Your Home Yourself (FSBO) · Step 1. Calculate the value of your home · Step 2. Advertise and list your home · Step 3. Cleaning, repairs, and. 1. Determine the Right Price for Your Home Based on Market Conditions · 2. Get Your House Ready for Sale · 3. Promote, Promote, Promote! · 4. Negotiate with Buyers. Picket Fence has empowered consumers with the knowledge and tools to buy and sell real estate without agents, and their outrageous commissions for decades. Browse exclusive homes for sale by owner or sell your home FSBO. forover-18.site helps you sell your home fast and save money. The first would be selling For Sale By Owner (FSBO). You may try using yard signs, Craigslist, and other internet sites like Zillow or forover-18.site They negotiate the price on your behalf. Their facilitations ensure that you get the best profitable deal from the sale of your home. Doing it on your own. FSBO homes typically sell for about 24% less than those listed with agents, which may outweigh the money you save doing it all on your own.[1] While you're not.

Pro Tip: An AS-IS home sale is often considered a distressed property and will need to be sold at a discount to a cash buyer, usually to real estate investors. Selling your own home means you'll be in charge of your marketing. Make sure your home is listed on the multiple listing service (MLS) in your area to reach. If you're on the fence about selling, you have a few choices: You can put your house up for sale to take advantage of current low inventory, you can wait to see. To sell your house fast in Denver, call us at () and tell us about your property and your current situation. Or you can fill out our fast cash home. You can also market the home on your own (i.e. handle all advertising, open houses, and private displays on your own), but use the attorney to process the. An agent with a full-service firm might even help to heavily market your property, hold open houses, and guide you through getting your home ready for showing. The Home Selling Process · Step 1—Get Started. Before the “for sale” sign goes up, make sure your home is ready — and so are you. · Step 2—List your home. Once. Having the Necessary Paperwork · A Residential Property Disclosure form · Payoff amount for your mortgage (mortgage statement) · Residential sales contract. When you sell a rent to own you can have an increased sales price and because there is no real estate agents involved, you will save on that 6% commission. You. The main advantage of selling your own home yourself is the potential to save on commission fees in return for doing the work of a real estate agent yourself. How To Sell Your Own Home: The Homeowners Guide to Selling Property by Owner rd Revision / [William F. Supple Jr.] on forover-18.site This is called For Sale By Owner (FSBO). Selling a $, house on your own could put $15, in your pocket that would have gone to your agent! But there's a. Saving 3% in sales commissions on a $, home is $15, A seller can pay a flat fee to list their home on the Multiple Listing Service (MLS) and do the. One of the most important aspects of selling is finding a great listing agent. Talk to a few agents before choosing one. Ask which homes they've sold in. Another advantage to FSBO is scheduling showings. For a seller who needs to show the home on their schedule, it's much easier to manage your own timeline rather. The main reason some homeowners prefer to sell a house without a realtor is the extra savings that can come out of the deal. Realtors typically get a 6% cut of. FOR SALE BY OWNER - List your property on forover-18.site & forover-18.site Sell your own home or land privately & pay NO Commission. Sell my house. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. You can sell your own home in any state without being (or using) a licensed real estate agent. It's not a good idea, but you can do it. The main advantage of selling your own home yourself is the potential to save on commission fees in return for doing the work of a real estate agent yourself.

Zip Pay Loan

Peloton has partnered with Zip in Australia to offer interest-free payment plans on new purchases of a Peloton Bike, Bike+ or Tread. What financing plans do you. Make your Bank OZK loan payment online – from your computer or smartphone. Pay with your savings or checking account (or by debit card for Guest User only). Someone suggested that I try to get an unsecured personal loan at 12% to wipe the Zip debt and pay off the loan instead. On paper it makes sense. Loan Payments · SDCCU Easy Pay · ACH Debit Payment (other bank account to SDCCU) · Online Bill Pay · Internet Branch Online Banking · By Phone · SDCCU Branch Location. Buy now pay later is interest-free, but it is debt · Zip's late fee cap is $ · Afterpay's late fee cap is $ If. In Australia, Zip offers Zip Pay and Zip Money, which have flexible repayment plans. Zip or its lending partner may extend credit to Zip customers for a fee. Zip Loan is a leading provider in retail consumer financing, offering a wide variety of flexible payment plans for our members. In addition to providing. Residents can borrow $ - $5, to cover their rent, partial rent, or move in expenses. You receive your rent payment by ACH as soon as the next business day. Flexible payment plans for small businesses with Zip Loan™. Our buy now, pay later solutions help businesses offer financing options to their customers. Peloton has partnered with Zip in Australia to offer interest-free payment plans on new purchases of a Peloton Bike, Bike+ or Tread. What financing plans do you. Make your Bank OZK loan payment online – from your computer or smartphone. Pay with your savings or checking account (or by debit card for Guest User only). Someone suggested that I try to get an unsecured personal loan at 12% to wipe the Zip debt and pay off the loan instead. On paper it makes sense. Loan Payments · SDCCU Easy Pay · ACH Debit Payment (other bank account to SDCCU) · Online Bill Pay · Internet Branch Online Banking · By Phone · SDCCU Branch Location. Buy now pay later is interest-free, but it is debt · Zip's late fee cap is $ · Afterpay's late fee cap is $ If. In Australia, Zip offers Zip Pay and Zip Money, which have flexible repayment plans. Zip or its lending partner may extend credit to Zip customers for a fee. Zip Loan is a leading provider in retail consumer financing, offering a wide variety of flexible payment plans for our members. In addition to providing. Residents can borrow $ - $5, to cover their rent, partial rent, or move in expenses. You receive your rent payment by ACH as soon as the next business day. Flexible payment plans for small businesses with Zip Loan™. Our buy now, pay later solutions help businesses offer financing options to their customers.

Residents can borrow $ - $5, to cover their rent, partial rent, or move in expenses. You receive your rent payment by ACH as soon as the next business day. Customers applying for home loans are required to disclose what they owe on their AfterPay and ZipPay accounts. This is now part of most banks' serviceability. Our convenient payment options make it easy to pay your loan online! Your 5-digit zip code; Your debit card information. To get started visit the. Save Yourself Time — Pay Your Loan Online Easily and Securely with QuickPay You'll need your account number, note number and your zip code; Payments made. Zip gives savvy shoppers more freedom and flexibility with our buy now, pay later platform. It's a smarter way to stretch your funds. You can easily make a one-time transfer from your Main Street account to pay your loan payment using our automated telephone banking services. Zip Code *. ZIP closing cost assistance: ◇ Zero interest junior loan. ◇ Up to 3% of the first mortgage loan amount in a deferred payment junior loan. Additional. the inquiry from zip pay will go on your credit file. and lenders will say is zip pay as like a credit card or a person alone. then they'll ask to see. While ZipPay offers customers buy now, pay later credit for purchases between $ and $1,, Zip Money is specifically targeted at larger purchases, with Zip. A ZIP loan provides secured subordinate (secondary) financing, most often paired with a Mortgage Origination Program (MOP) loan in first position (a ZIP loan. ZIP Pay Later loan equips users with up to Rs 60, at 0% interest* which can be used at their favourite brands to shop, order groceries, medicines, food, pay. Also using zip pay or afterpay shows poor money management which could make it harder for you to get a loan. (So i have been informed, do not quote me on. Zip (previously Quadpay) gives savvy shoppers more freedom and flexibility to buy now, pay later where they want with the Zip app. Zip is a payment method that allows you to split nearly any purchase (including taxes, shipping charges and finance charges) into easy payments. Borrow from $1, up to $5, with Zip Money and get a minimum of three interest-free months. With Zip Money, you can pay for purchases without cash or a. While ZipPay offers customers buy now, pay later credit for purchases between $ and $1,, Zip Money is specifically targeted at larger purchases, with Zip. ZIP Home Loan Visa debit card has maximum limit of $5,, and cannot be used as part of loan settlement. ZIP Visa debit card facility may be cancelled and/or. Afterpay is fully integrated with all your favorite stores. Shop as usual, then choose Afterpay as your payment method at checkout. It is a lot cheaper than getting an advance loan, payday loans etc. Zip Pay Anywhere and Zip Checkout financing through Zip issued by WebBank. All loans are subject to credit approval. What information does Zip ask for? Zip.

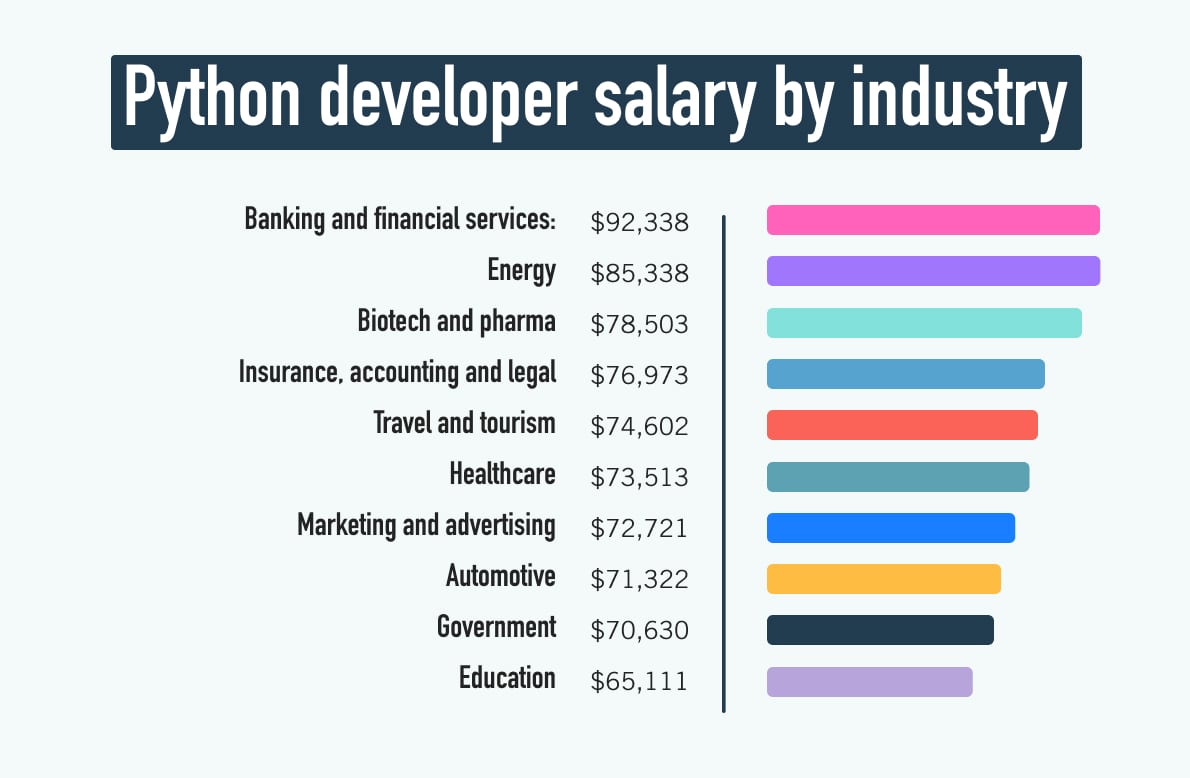

How Much Does A Programmer Make A Year

Pay. The median annual wage for computer programmers was $99, in May Job Outlook. Employment of computer programmers is projected to decline 10 percent. The average salary for a Java developer is ~$k per year. Salary mean: ~$k; Salary median: $k; Jobs Found (with salary): 23K jobs; Keywords: Java. Go. The average salary for a Programmer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could earn the. Senior-level programmers, known for deep expertise and leadership skills, often earn over $, In tech hubs or for those skilled in new technologies, this. Programmer salary in India with less than 1 year of experience to 7 years ranges from ₹ Lakhs to ₹ Lakhs with an average annual salary of ₹ Lakhs. The average salary for a computer programmer in California is around $95, per year. How much does a computer programmer make in California? How do computer. The average salary for computer programmers in the United States is around $ per year. Salaries typically start from $ and go up to $ CNC Programmer (Computer Numerical Control Programmer)s make an average of $ / year in USA, or $ / hr. Try forover-18.site's salary tool and access the. The average salary for a Computer Programmer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could. Pay. The median annual wage for computer programmers was $99, in May Job Outlook. Employment of computer programmers is projected to decline 10 percent. The average salary for a Java developer is ~$k per year. Salary mean: ~$k; Salary median: $k; Jobs Found (with salary): 23K jobs; Keywords: Java. Go. The average salary for a Programmer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could earn the. Senior-level programmers, known for deep expertise and leadership skills, often earn over $, In tech hubs or for those skilled in new technologies, this. Programmer salary in India with less than 1 year of experience to 7 years ranges from ₹ Lakhs to ₹ Lakhs with an average annual salary of ₹ Lakhs. The average salary for a computer programmer in California is around $95, per year. How much does a computer programmer make in California? How do computer. The average salary for computer programmers in the United States is around $ per year. Salaries typically start from $ and go up to $ CNC Programmer (Computer Numerical Control Programmer)s make an average of $ / year in USA, or $ / hr. Try forover-18.site's salary tool and access the. The average salary for a Computer Programmer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could.

Entry-level programmers earn an average of about $60, annually while midcareer computer programmers earn over $70, each year on average. currency-dollar. How much does an Entry Level Programmer make in the United States? The average Entry Level Programmer salary in the United States is $85, as of August Do we count this reality into our calculation? As with the Syntactic Elements argument before, I would say the answer is “Yes.” The programmer. How much does a computer programmer make? $93, The average salary for year , which is much faster than the national average. Technology is. $80, is the 75th percentile. Salaries above this are outliers. $87, is the 90th percentile. Salaries above this are outliers. $83, - $89, 7% of. The average salary for computer programmers is $, per year ($ per hour) according to BLS data. Keep in mind this is not an entry-level wage and you. The median average medical billing and coding salary is $48, per year or $ per hour, according to the Bureau of Labor Statistics (BLS), but many. The average salary for a Computer Programmer is $ per year in United States How much does a Computer Programmer make in the United States? Average base. If you're a tl;dr kind of reader, here's the short version: Game programmer salaries range from $44, (entry-level) to $,+ per year (senior/lead. What can I earn as a Programmer? The average annual salary for Programmer jobs in Australia ranges from $90, to $, $70K. $90K. A Computer Programmer in your area makes on average $66, per year, or $1 (%) more than the national average annual salary of $64, The estimated total pay for a Computer Programmer is $97, per year, with an average salary of $80, per year. These numbers represent the median, which is. In , the average computer programmer earned $57, annually, but today, they earn $70, a year. That works out to a 12% change in pay for computer. The average salary for a Computer Programmer is $ in Visit PayScale to research computer programmer salaries by city, experience, skill. How Much Does a Software Developer Make? Software Developers made a median salary of $, in The best-paid 25% made $, that year, while the. Despite declining employment, about 6, openings for computer programmers are projected each year, on average, over the decade. programmers do and can. Entry-level pay starts out at around $35, per year while experienced CNC programmers earn over $75, annually. Applicants need to be able. Yes, $80k+ is typical in the Bay Area. On Glassdoor, for example, a Game Programmer average salary is about ~90k in SF and about ~70k in Austin. The average salary for a computer programmer in California is around $95, per year. How much does a computer programmer make in California? How do computer. Entry level positions start at $77, per year while most experienced workers make up to $, per year. Median. $, chart. Low. $77, High.

Best Accounting Software For Trucking Business

Welcome to Trucking Pro Software, the ultimate solution for professional owner operators. Our trucking accounting software is designed to streamline your. Benefits of Double-Entry Accounting for Your Independent Owner Operator Trucking Business Managing your books in now easier than ever with FreshBooks. Our. TruckLogics's Recurring Deduction Management streamlines and simplifies the deduction process that saves time, resources, and money for your trucking business. SoftwareSuggest's curated list of Transportation Accounting Software helps you make better decisions, ensuring you select the most suitable software for your. TruckBytes provides complete accounting and truck management at no cost to the user. The solution was created as an alternative for manual record keeping for. Best Payroll Software for Trucking Companies in There are many trucking accounting software programs specifically designed for trucking businesses, so. Axon's real-time totally integrated accounting software for trucking companies saves you more time than any other system available today – no exceptions. Telematics software records data on your employees driving habits, including average speeds, fuel usage and braking tendencies. This can. Learn how Sage Intacct software can drive accounting for trucking companies, airlines and other transport services, saving you time and money. Welcome to Trucking Pro Software, the ultimate solution for professional owner operators. Our trucking accounting software is designed to streamline your. Benefits of Double-Entry Accounting for Your Independent Owner Operator Trucking Business Managing your books in now easier than ever with FreshBooks. Our. TruckLogics's Recurring Deduction Management streamlines and simplifies the deduction process that saves time, resources, and money for your trucking business. SoftwareSuggest's curated list of Transportation Accounting Software helps you make better decisions, ensuring you select the most suitable software for your. TruckBytes provides complete accounting and truck management at no cost to the user. The solution was created as an alternative for manual record keeping for. Best Payroll Software for Trucking Companies in There are many trucking accounting software programs specifically designed for trucking businesses, so. Axon's real-time totally integrated accounting software for trucking companies saves you more time than any other system available today – no exceptions. Telematics software records data on your employees driving habits, including average speeds, fuel usage and braking tendencies. This can. Learn how Sage Intacct software can drive accounting for trucking companies, airlines and other transport services, saving you time and money.

Freshbooks is known for its simplified invoicing and billing processes, making it an ideal choice for trucking companies. You can streamline your invoicing. This article discusses some of the best software solutions that are specifically designed to do accounting for the trucking business. Trucking companies also use QuickBooks' accounting and payroll software together to simplify bookkeeping and manage business finances all in one place. No. QuickBooks Online makes accounting easy. Make tracking receipts, income, bank transactions, and more feel simple with the #1 small business accounting software. Review financial reports, generate invoices, and import expenses with FreshBooks' fast & secure trucking accounting software. Start your free day trial. Free Trucking Accounting Software · Zoho Books · Agiled · TopNotepad · ZipBooks · Momenteo · InvoiceBerry · Billed · FINSYNC. With the peace of mind in knowing that Porte Brown is handling your trucking accounting needs, you will be free to concentrate on doing your best work elsewhere. QuickBooks is one of the most popular accounting software options for small businesses and offers a range of features that can benefit trucking businesses. In. Trucking Accounting Software · QuickBooks Enterprise · QuickBooks Online · NetSuite · QuickBooks Online Advanced · Zoho Books · Sage Intacct · Patriot Accounting. A popular integrated accounting system is Enterprise Resource Planning (ERP) software. ERP software helps logistics and transport companies manage day-to-day. Truckn Pro Pricing and cost · Truckn Pro bookkeeping and accounting package for truckers brief summary: · Tailwind owner operatoe record keeping software cost. Best Trucking Software At A Glance · G2 Grid® for Trucking. You are probably a boss in the trucking industry, with your fleet of trucks and employees. But in handling your business accounting? Not so much. While that's not sufficient for a trucking business, it's a great place to start. Any custom-built trucking accounting software out there today is going to. Q7: A Leading Software For Trucking Companies · Intuit Quickbooks Online: Great For On-the-Go Accounting · Why Choose AWA for Your Transportation Collection Needs. For this reason, ZarMoney has positioned itself as a powerful software for trucking companies, offering features that streamline accounting processes and. Tripta Accounting Software often comes highly recommended. It is renowned for its ease of use, comprehensive features, making it a favorite. Find and compare the best Trucking Accounting software in · QuickBooks Online · Sage Intacct · AccountEdge · NolaPro · BizAutomation · TopNotepad · Patriot. For instance, QuickBooks Online is a widely-used accounting software that can be easily integrated with trucking software like RAMA Logistics Software (RLS) to. TruckingOffice offers powerful features tailored to your needs. For example, our fleet maintenance tools enable you to stay on top of every aspect of vehicle.