forover-18.site Overview

Overview

20 Year Personal Loan

Try our Line of Credit & Loan Payment calculator now to estimate your minimum line of credit payments or installment payments on a personal loan. years of age, and have a valid U.S. Social Security Number to be considered for an Arkansas Federal personal loan. The maximum loan amount for an Arkansas. The best long-term personal loans offer lengthy terms, competitive rates and low fees. Find the best option for you here. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. With a Personal Loan from Regions, borrow money to cover major expenses, consolidate debt, fund large purchases and more. Apply for a loan today. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting. Our unsecured loan solutions allow Canadians in the fair to good credit score range to borrow money for debt consolidation, unexpected expenses and more. That's why the Fortune Recommends editorial team reviewed more than 20 lenders for personal loans. (The average rate for a two-year personal loan is just. Our surprise-free personal loan options offer you monthly payments at an interest rate of % per month, with terms ranging from 12 to 60 months. Try our Line of Credit & Loan Payment calculator now to estimate your minimum line of credit payments or installment payments on a personal loan. years of age, and have a valid U.S. Social Security Number to be considered for an Arkansas Federal personal loan. The maximum loan amount for an Arkansas. The best long-term personal loans offer lengthy terms, competitive rates and low fees. Find the best option for you here. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. With a Personal Loan from Regions, borrow money to cover major expenses, consolidate debt, fund large purchases and more. Apply for a loan today. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting. Our unsecured loan solutions allow Canadians in the fair to good credit score range to borrow money for debt consolidation, unexpected expenses and more. That's why the Fortune Recommends editorial team reviewed more than 20 lenders for personal loans. (The average rate for a two-year personal loan is just. Our surprise-free personal loan options offer you monthly payments at an interest rate of % per month, with terms ranging from 12 to 60 months.

A month (20 year) loan at % will have monthly payments of $ per $1, borrowed.

Offered by Happy Money, the Payoff personal loan is specifically designed for credit card debt consolidation. Loans range from $5, to $40,, with repayment. A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly. Example: for a 7 year (84 month), $20, new auto loan at the rate of %, multiply 20 x $ for a payment amount of $ (loan amount ÷ $1, x. How much can I apply for and what loan terms are available?Expand · 12 – 36 months for personal loans ranging from $3, to $4,Footnote 1 · 12 – 84 months. year draw period with balance due at maturity; Interest-only monthly payments; Annual Percentage Rates range from % to %. No annual fee; Fund. Payment Examples. Fixed Rate Loans. Term, Interest Rate, APR, No. of Payments, Monthly Payment, Total Payments. 3 Year A borrower may be charged $20 for any. Private Mortgage Insurance is required for 15, 20 and year fixed loans with less than 20% down payment. Personal Loan Rates. Product. Term. Rate. APR. Per period, the rate is determined by dividing the annual interest rate by the number of payments made each year. %. Loan Payment: $ A long-term personal loan can help you pay for a major expense if you don't have enough cash on hand. By borrowing a lump sum and repaying it over many. An annual fee is not assessed during the year repayment period after the draw period. The APR shown is for a $14, personal loan of 60 months. 20 years, 21 years, 22 years, 23 years, 24 years, 25 years. Interest Rate Outstanding Loan Balance. View: Amortization by Year, Amortization by Payment Period. Use Fairstone's loan payment calculator to estimate what your personal loan payments could be based on loan amount, term and payment frequency. Loan Calculator · Personal · Loans and Lines of Credit; Loan Calculator. Loans and Lines of Credit Enter an interest rate. Amortization. 1 year, 2 years, 3. You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover. Personal Loan. Pay off bills, finance a vacation or build your credit You must wait one year and one day from the closing of your Home Equity Loan. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. If you need to borrow a sizable amount of money – such as $20, or more – a personal loan may be your best option. Personal loans allow you to borrow. When it comes to credit union personal loan rates, TruStone Financial delivers affordable options Year Fixed Rate, %, %. Year Fixed Rate. What are the interest rates on a $20K personal loan? Acorn Finance partners with top-rated and competitive lenders that offer personal loans up to $, Personal Loan features & benefits · Apply online in minutes. · Flexible terms · No fees · Rate discount · We'll take care of your needs · Consolidate credit card debt.

Forest Reit

As a Registered Investment Adviser and environmental steward, Forest Investment Associates (FIA) helps clients across the world invest in sustainable. Learn more about the REIT Forest City Realty Trust, Inc. FCE.A NYSE before investing. PotlatchDeltic is a timberland real estate investment trust (REIT) with geographically diverse, high quality, productive timberlands. With the highest. We offer fully integrated, global, and sustainable timberland investment solutions across a variety of tree species, age classes, and end products. PotlatchDeltic is a timberland real estate investment trust (REIT) with geographically diverse, high quality, productive timberlands. Timberland REIT public as CatchMark Timber Trust. He has been responsible Forest Landowners Association (FLA) and the Georgia Forestry Association (GFA). ▻ A REIT passes its timber income (from sales of timber and timberland) to its shareholders as capital gains (rather than ordinary income), which is subject to. National Timberland REIT Hires VP, General Counsel. We are pleased to announce that Michele Tyler has joined PotlatchDeltic in Spokane, Washington, as VP. A REIT's timber interests will be treated as real property and reimbursements it receives from other subsidiaries will not be treated as gross income. As a Registered Investment Adviser and environmental steward, Forest Investment Associates (FIA) helps clients across the world invest in sustainable. Learn more about the REIT Forest City Realty Trust, Inc. FCE.A NYSE before investing. PotlatchDeltic is a timberland real estate investment trust (REIT) with geographically diverse, high quality, productive timberlands. With the highest. We offer fully integrated, global, and sustainable timberland investment solutions across a variety of tree species, age classes, and end products. PotlatchDeltic is a timberland real estate investment trust (REIT) with geographically diverse, high quality, productive timberlands. Timberland REIT public as CatchMark Timber Trust. He has been responsible Forest Landowners Association (FLA) and the Georgia Forestry Association (GFA). ▻ A REIT passes its timber income (from sales of timber and timberland) to its shareholders as capital gains (rather than ordinary income), which is subject to. National Timberland REIT Hires VP, General Counsel. We are pleased to announce that Michele Tyler has joined PotlatchDeltic in Spokane, Washington, as VP. A REIT's timber interests will be treated as real property and reimbursements it receives from other subsidiaries will not be treated as gross income.

That work led to our representation of the first privately held timber REIT and all but one of the publicly traded timber REITs as of ; Forest City; and. Adams and Reese advises forestry companies, loggers, lumber mills, large private landowners, timber investors – TIMOs, REITs, pension funds. Forest City Realty Trust, Inc., formerly Forest City Enterprises, was a real estate investment trust that invested in office buildings, shopping centers and. A REIT is a tax efficient entity for holding real estate such as timberland: ▻ A REIT does not pay federal income taxes on its income that it pays out . A timber. REIT specializes in timberland investment and is subject to general and special timber REIT tax laws and rules. The choice of corporate forms—a C-. From a tax standpoint, a REIT is a tax efficient entity for holding real estate such as timberland: ▻ A REIT does not pay federal income taxes on its in- come. Brooks Mendell, Ph.D. is President and Founder of Forisk Consulting, a forest industry, timber REIT, bioenergy and timber market research firm. One of the oldest publicly traded real estate companies in the U.S. celebrated the new year by becoming a REIT named Forest City Realty Trust. REIT's timberland investment, the Mahrt Timberland, Wells Timberland. REIT downturn in the real estate industry generally or the timber or forest. Purchasing it themselves; Purchasing publicly traded shares in a timber REIT; Engaging with a Timberland Investment Management Organization (TIMO) to purchase. Rayonier (NYSE: RYN) is a leading timberland real estate investment trust (REIT) committed to creating value through excellence in our core businesses. What makes Timber REITs special, is their ability to adjust harvest rates when prices are unfavourable and preserve and grow their asset base. This allows. We integrate these disciplines with an expansive array of forest management capabilities, including biometrics, tree genetics and timber and land merchandising. Forest Fund IV LP; The Lyme Forest Fund IV TE LP; The Lyme Forest Fund IV FB LP; LFF IV GP LLC; LFF IV TE REIT LLC; The Lyme Forest Fund V LP; The Lyme. A Timber Investment Management Organization (TIMO) is a management group that aids institutional investors in managing their timberland investments. Timber real estate investment trusts (REITs) make money by harvesting trees grown on their land. To continue paying dividends to investors, timber REITs. Independent Disciplined Focused Experienced Mark Seaman on TIR and its Culture Initial Assessment of How Conflict in Ukraine Could Impact Timberland. The NCREIF Timberland Index is a quarterly time series composite return measure of investment performance of a large pool of individual U.S. timber. real estate investment trusts (REITs) and conservation organizations. The Why would a REIT own a forest? Timberlands emerged as an attractive. A REIT's timber interests will be treated as real property and reimbursements it receives from other subsidiaries will not be treated as gross income.

Bbig Robinhood

HOOD stock - Robinhood stock live price alert. stocks and crypto · forover-18.site (SPRT) stock Live | BBIG stock Live. stocks and crypto · 5M posts. Discover videos related to Bbig Stock August on TikTok. See more Best Penny Stocks to Buy Now Robinhood · Best Penny Stocks April Why Robinhood? Robinhood gives you the tools you need to put your money in motion. You can buy or sell Big Lots and other ETFs, options, and stocks. Robin Hood is mistaken for Peter Pan; and Leonard (dressed as Frodo Baggins from The Lord of the Rings) is insecure. Penny's ex-boyfriend Kurt (underdressed. InvestorPlace - Stock Market News, Stock Advice & Trading TipsAlthough BBIG Robinhood Has Dropped Too Far, Too Fast With an Overdone Correction. darthbobby / Robinhood / Running P&L. Posts · Trades · Open Trades · Stats /BBIG(HB,H), /BBIO, /BBLG(HB), /BBLG(HB,F), /BDRX, /BDRX(HB), /BENF(HB), /BFRG. bbig is being discussed heatedly; come and join tens of millions investors to discuss bbig. here is my robinhood link forover-18.site more more $bbig stock might be the next short squeeze · Videos · Update on $siga. Robinhood pioneered the zero-commission brokerage trend building a mobile-first application for buying and selling securities. HOOD stock - Robinhood stock live price alert. stocks and crypto · forover-18.site (SPRT) stock Live | BBIG stock Live. stocks and crypto · 5M posts. Discover videos related to Bbig Stock August on TikTok. See more Best Penny Stocks to Buy Now Robinhood · Best Penny Stocks April Why Robinhood? Robinhood gives you the tools you need to put your money in motion. You can buy or sell Big Lots and other ETFs, options, and stocks. Robin Hood is mistaken for Peter Pan; and Leonard (dressed as Frodo Baggins from The Lord of the Rings) is insecure. Penny's ex-boyfriend Kurt (underdressed. InvestorPlace - Stock Market News, Stock Advice & Trading TipsAlthough BBIG Robinhood Has Dropped Too Far, Too Fast With an Overdone Correction. darthbobby / Robinhood / Running P&L. Posts · Trades · Open Trades · Stats /BBIG(HB,H), /BBIO, /BBLG(HB), /BBLG(HB,F), /BDRX, /BDRX(HB), /BENF(HB), /BFRG. bbig is being discussed heatedly; come and join tens of millions investors to discuss bbig. here is my robinhood link forover-18.site more more $bbig stock might be the next short squeeze · Videos · Update on $siga. Robinhood pioneered the zero-commission brokerage trend building a mobile-first application for buying and selling securities.

The Big Five banks dubbed too big to fail, are 35 percent bigger than they Robin Hood · self-sacrificing · ample. adjectiveas in more than necessary. BIG / Big Lots, Inc. 2,,, ,, , , , 13G/A Robinhood Markets, Inc. , , , , , DTM / DT. Robin Hood is mistaken for Peter Pan; and Leonard (dressed as Frodo Baggins from The Lord of the Rings) is insecure. Penny's ex-boyfriend Kurt (underdressed. BIG always BBIG always View the real-time BIGC price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. View BBIG price history, and other historical data. Get the latest (BBIG) Robinhood Top Artificial Intelligence Stocks Under $10 · Penny Stock To Buy. 5M posts. Discover videos related to Bbig Stock August on TikTok. See more Best Penny Stocks to Buy Now Robinhood · Best Penny Stocks April BBIG Vinco Ventures Inc stock OTC. EOD. 6/7/ USD%()1, RobinHood. Shortsqueeze. solana. SqueezePlays. StockMarket. stocks. $MMTLP $MMAT $TRCH $DJT $AMC $GTII $GME $BBIG $MULN $FNGR $CLNV $GNS $PLTR $MCOM $TSLA $COSM $NWBO $WULF $VIRI $BBBYQ $KODK $NVOS $KOSS. ROBINHOOD MKTS INC COM CL A,Pennies all 2HPE,HEWLETT PACKARD ENTERPRISE CO BBIG,VINCO VENTURES INC COM,Pennies to BBIG1,VINCO VENTURES INC COM. Vinco Ventures Inc. SEC filings breakout by MarketWatch. View the BBIG U.S. Securities and Exchange Commission reporting information. Looking for stock tips, technical analysis assistance, watch lists, workspace set-ups, Robinhood/general stock market advice? Look no further! My $BBIG - WOW! Find the latest Vinco Ventures, Inc. (BBIG) stock quote, history, news and other vital information to help you with your stock trading and investing. OSMO crypto price predictions are of keen interest to investors today after they noticed the fledgling platform post new all-time highs. BBIG Stock Pops Once. Find the latest Vinco Ventures, Inc. (BBIG) stock quote, history, news and other vital information to help you with your stock trading and investing. Big Lots shares (BIG) are listed on the NYSE and all prices are listed in Robinhood. Finder Score: / 5. Robinhood.. Stocks. Robinhood pulls the buy button once again, this time on their " #transparency #gme #amc #Koss #bbig #bbbyq #bbby #mmat #mmtlp. BBIG. Canadapennystocks. CanadianInvestor. CLOV. Daytrading. DeepFuckingValue RobinHood. Shortsqueeze. SqueezePlays. StockMarket. StockMarketChat. stocks. BREAKING NEWS: #SHIB WILL BE LISTED ON ROBINHOOD AT 9AM EST 11/01/! You heard it hear first. #Robinhood #cryptocurrencies #ShibaArmy #ShibaCoin. #BBIG #KPLT #AMC #DOGECOIN #GME #ROBINHOOD #STOCKS #CRYPTO · #KPLT#salam buat Gillatz of king created by DJ Alvin with · #KPLT #ATIM #alvin

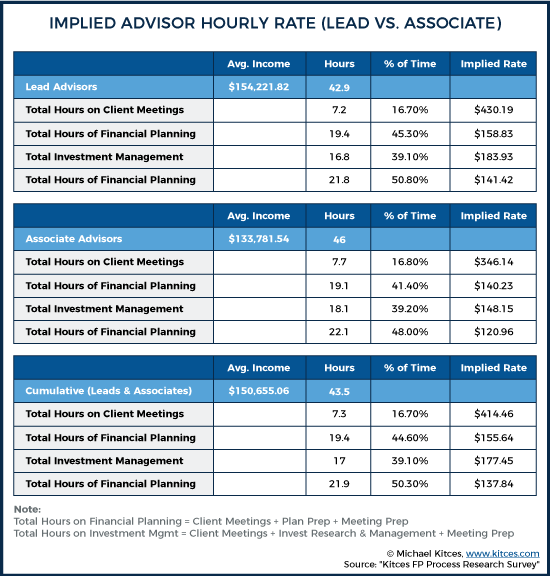

How Much Does It Cost To Hire A Financial Advisor

Hourly Fees: Some advisors charge by the hour, with rates typically ranging from $ to $ per hour, depending on their experience and. Financial advisors may also charge by the hour, with rates ranging from $ to $ and up. Hourly fees might be used for specific projects, such as developing. Typically they charge between % - 1% of total managed assets. They can put you in funds that have similar charges. They are also not liable. The median hourly rate for Financial Advisors is $ Hourly rates for Financial Advisors on Upwork typically range between $30 and $ Average price $ - $ per hour. What is the price of hiring a Financial Advisor? Are you looking for advice on how best to manage your finances? According to Advisor Ratings, the average cost of a financial advisor is about $3, As with any profession, this can increase to upwards of $30, depending. The cost of hiring a flat fee financial advisor can vary significantly from $1, to $10, per year (or more), depending on the scope and detail of the. Account fees and costs Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary. However, if your investment size is estimated close to $,, a financial advisor can charge you approximately $7, For an investment ranging between. Hourly Fees: Some advisors charge by the hour, with rates typically ranging from $ to $ per hour, depending on their experience and. Financial advisors may also charge by the hour, with rates ranging from $ to $ and up. Hourly fees might be used for specific projects, such as developing. Typically they charge between % - 1% of total managed assets. They can put you in funds that have similar charges. They are also not liable. The median hourly rate for Financial Advisors is $ Hourly rates for Financial Advisors on Upwork typically range between $30 and $ Average price $ - $ per hour. What is the price of hiring a Financial Advisor? Are you looking for advice on how best to manage your finances? According to Advisor Ratings, the average cost of a financial advisor is about $3, As with any profession, this can increase to upwards of $30, depending. The cost of hiring a flat fee financial advisor can vary significantly from $1, to $10, per year (or more), depending on the scope and detail of the. Account fees and costs Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary. However, if your investment size is estimated close to $,, a financial advisor can charge you approximately $7, For an investment ranging between.

Most financial advisors charge 1 percent of the AUM. A fee higher than this may be considered too high for many individuals, as it represents a significant. The average percentage, based on the number of assets under management (AUM) for ongoing advising, is about 1% annually, but an advisor may charge less if you. The initial costs of hiring a financial advisor can vary. Many financial advisors will offer a free initial consultation/meeting. In this meeting, the financial. 1. Hourly Rates: Typically range from $ to $ per hour. · 2. Flat Fees: These can range from $1, to $5, per year for comprehensive. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. If you pay on average $1, to $2, a year on an advisor, but they allow you to save an extra $2, a year from careful planning and boost your retirement. Costs Of Hiring A Financial Advisor · Percentage of Assets Managed: Advisors may charge between % to 2% of your managed assets annually. · Flat Fees. Flat rate fees tend to start from $1, and can go up to $3, for one-time consultancy fees for designing an exhaustive financial plan. These fees tend to. Are you wondering if an hourly fee financial advisor is right for you? A growing number of financial advisors work on an hourly basis, with prices ranging. A stand-alone plan like this typically costs $1, to $3, Some charge a flat annual fee (usually ranging between $2, and $7, per year) for the plan. Our fee-based financial planner charges us $ now I think. It was $ for a decade for existing clients but she raised it last year. That's a. The average cost of hiring a financial advisor is usually around 1% of the amount of assets they manage, but there is no firm rule about how much financial. – Flat fee of $2, to $4, for a one-time service. The costs vary greatly, as you can see. Why do the costs vary significantly? If you're ready to start investing, it can be good to work with a financial planner who is qualified to give advice about the stock market. A qualified. 1. Works with you to create a personalized investment plan · Are your spending and cash flow appropriate? · What does financial protection mean to you, and how. How much does a financial advisor cost? · A percentage of the total amount of your portfolio, ranging from % to 1% a year, according to personal-finance. The fees can range from as low as percent if you have half a billion or more invested—or, if you are investing with a money manager, the fee could be as. Hourly rates for these advisors usually sit at $ Some may ask for a fixed fee. You might pay about $2, for this type of plan cost. Often they charge. The median hourly rate for Financial Planners is $ Hourly rates for Financial Planners on Upwork typically range between $35 and $ Generally, the rate for an hourly-fee advisor ranges between $ and $ per hour. Based on the expertise of the advisor you choose, they may charge more than.

Are Discover Cards Worth It

Benefits of Discover cash back credit cards · Unlimited Cashback Match · Redeem with Ease · 99% Nationwide Acceptance · $0 Fraud Liability Guarantee · Online Privacy. The Bank of America® Travel Rewards credit card offers unlimited points per $1 spent on all purchases everywhere, every time and no expiration on points. The Discover it® Cash Back is a good credit card that's worth it for people with a credit score of + who want a $0 annual fee and a high rewards rate. And are cash back cards worth it? If you're thinking of applying for one, learn about the different types of cash back cards, how to redeem cash back and the. If the deal is approved, Capital One customers may see their cards moved to the Discover network by early Discover in an all-stock transaction worth. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. The Discover Card offers no annual fee and cash back on purchases. They also have among the best customer service. More than 90% of the. Cash Back Calculator. Calculate how much cash back you can earn with the Discover it Cash Card based on your spend. Results can be compared side by side any. Discover cards are widely accepted and offer competitive rates and rewards. If used conscientiously, the automatic cash-back match during the first year offers. Benefits of Discover cash back credit cards · Unlimited Cashback Match · Redeem with Ease · 99% Nationwide Acceptance · $0 Fraud Liability Guarantee · Online Privacy. The Bank of America® Travel Rewards credit card offers unlimited points per $1 spent on all purchases everywhere, every time and no expiration on points. The Discover it® Cash Back is a good credit card that's worth it for people with a credit score of + who want a $0 annual fee and a high rewards rate. And are cash back cards worth it? If you're thinking of applying for one, learn about the different types of cash back cards, how to redeem cash back and the. If the deal is approved, Capital One customers may see their cards moved to the Discover network by early Discover in an all-stock transaction worth. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. The Discover Card offers no annual fee and cash back on purchases. They also have among the best customer service. More than 90% of the. Cash Back Calculator. Calculate how much cash back you can earn with the Discover it Cash Card based on your spend. Results can be compared side by side any. Discover cards are widely accepted and offer competitive rates and rewards. If used conscientiously, the automatic cash-back match during the first year offers.

Using a cashback credit card on your everyday purchases can help you earn valuable rewards and put more money back in your bank account. There are a number of great cash back cards with no annual fee, such as the Home Trust Preferred Visa or the SimplyCash Card from American Express. However. If you need to spread the cost of your trip, a credit card might suit better. Many Discover cards also give cash-back or rewards to help you travel more in. Rewards cards offer tempting sign-up deals to consumers with good credit scores. · Annual fees might be worth paying for frequent travelers and big spenders. This card has given me more financial freedom and has helped me manage my expenses better than ever before. The mobile app is user-friendly, making it easy to. CreditDonkey® Credit Card Reviews · 5% bonus rotating categories · Intro APR on purchases and balance transfers · No foreign transaction fee · No annual fee. Rewards: You can expect good cash back and mileage rewards programs from Discover cards. Plus you get an unlimited match of all the cash back you earn (or, for. ² When you redeem Cashback Bonus for an forover-18.site Gift Card on forover-18.site or in the Discover mobile app, you get 5% added value. Miles cannot be redeemed for. The great thing about the Miles that you earn with the Discover® travel card is that they can be used to cover all or part of a travel expense. So the amount of. Overview. The Discover it® Cash Back credit card is a no-annual-fee card offering 5% back in spending categories that change every quarter, plus 1% on all other. A Complete Guide to Discover® Credit Card Benefits · INTRO OFFER: Unlimited Cashback Match for all new cardmembers–only from Discover. · Earn 5% cash back on. The miles never expire and are worth one cent each regardless of how you decide to redeem them. What is Discover? Before we talk about the differences between. Are these cards worth it? I hate annual fees. I hate recurring fees of any kind. Controlling cost is one of the few things that has always. Different credit cards offer a variety of points, miles and cash back — all worth varying amounts. Figure out which type of rewards card is best for you. Drawbacks of Discover it® Cash Back · Categories aren't always lucrative · You have to activate the categories each quarter · There's a cap on bonus cash back. If you are heading off to college and looking for your first credit card, Discover it® Student Cash Back is an excellent choice. Not many other student credit. Earn 50, bonus points worth $ in travel. on prepaid hotels and car rentals booked directly in the Altitude Rewards Center. on travel purchases and. Is the Discover it® Cash Back worth it? The Discover it® Cash Back is a solid cash back credit card. It offers 5% back in rotating categories that must be. Discover is the third largest credit card brand in the U.S., with million cardholders or about 8% of cards in circulation, placing it well behind Visa (

John Hancock Rollover 401k

Sign in here to access your account if you have an IRA or another mutual fund account type with John Hancock Investment Management. Retirement Savings (k) · Legal. Translation Disclaimer. Google Translate When should I contact John Hancock after I leave covered employment? If you. Use this form to roll over or transfer assets to a traditional or Roth IRA at John Hancock Investment Management. For more information contact John Hancock at John Hancock Investments Rollover IRA example, (k) plans and section (b) plans maintained. You may request a rollover contribution withdrawal by contacting John Hancock. You should, however, consult with your tax advisor before exercising this. Capitalize will help you roll over from your Fidelity (k) provider to a John Hancock IRA. Explore the benefits and learn how to roll over a (k). With a direct rollover, your money is transferred directly from the old plan into your new one, so you never have it in your own hands. With an indirect. If you would like to consolidate other retirement accounts ((k), (b)1, (b), IRA, etc.) into your current plan with John Hancock, please follow the. Generally, the timeline for your old plan's rollover will vary depending on a number of factors. We typically give a business day timeline. Sign in here to access your account if you have an IRA or another mutual fund account type with John Hancock Investment Management. Retirement Savings (k) · Legal. Translation Disclaimer. Google Translate When should I contact John Hancock after I leave covered employment? If you. Use this form to roll over or transfer assets to a traditional or Roth IRA at John Hancock Investment Management. For more information contact John Hancock at John Hancock Investments Rollover IRA example, (k) plans and section (b) plans maintained. You may request a rollover contribution withdrawal by contacting John Hancock. You should, however, consult with your tax advisor before exercising this. Capitalize will help you roll over from your Fidelity (k) provider to a John Hancock IRA. Explore the benefits and learn how to roll over a (k). With a direct rollover, your money is transferred directly from the old plan into your new one, so you never have it in your own hands. With an indirect. If you would like to consolidate other retirement accounts ((k), (b)1, (b), IRA, etc.) into your current plan with John Hancock, please follow the. Generally, the timeline for your old plan's rollover will vary depending on a number of factors. We typically give a business day timeline.

Individual retirement (IRA) or mutual fund accounts · IRAs rolled over from (k) · All other IRAs, retirement, and non-retirement mutual fund accounts. (a)/(k) plan or (b) plan or governmental NOTE: You may change the investment of your existing account balance by contacting John Hancock. 3 Roll your (k) to an IRA—An IRA rollover can offer similar tax John Hancock Retirement Plan Services LLC provides administrative and/or. John Hancock Funds IRA/Roth IRA - To rollover to a new John Hancock Funds If the rollover distribution includes Roth (k) money that portion must. Our IRAs offer more choices when it comes to continuing to save. Call us at or get in touch online to speak with a rollover education specialist. I had a company-sponsored K with them. When I changed employers, I decided to consolidate K plans. "John Hand-Job" charged me $75 to transfer my K. Three of the options – leaving your money in the plan, moving it to your new employer's plan and rolling over to an IRA – will allow you to continue to earn. John Hancock does not record-keep this information. (a) Rollover designation includes assets rolling in from a (k) plan. Beginning in , after tax. If you have other retirement accounts, such as a (k) Rollovers are available for plans using John Hancock's Consolidation Services; rollovers are subject to. Contact John Hancock if you are interested in making a rollover contribution. Page 9. Fujitsu Group (k) Plan. 6. OHSUSA Retirement Savings. Here, we'll review the general process for rolling over your John Hancock (k) to an institution and account of your choice. Whether you're changing jobs or retiring or taking a withdrawal for other reasons, removing your money from a (k) Direct Rollover to John Hancock Mutual. Additional copies as well as detailed Plan and investment information are available through John Hancock. GENERAL INFORMATION ABOUT ROLLOVERS. How can a. Rolled over to the John Hancock Investments IRA from a John Hancock (k) assisted by either John Hancock's Rollover Education Center or the digital rollover. Follow these 3 easy steps · If you're rolling over pre-tax assets, you'll need a rollover IRA or a traditional IRA. · If you're rolling over Roth (after-tax). Rollover IRAs offer you the freedom of choice and flexibility. You can choose the financial institution, and you're no longer bound by the investments offered. It's a guaranteed withdrawal benefit built specifically for (k) plans. roll over the Benefit Base and market value into an eligible John Hancock. To opt out or make changes to your deferral rate, contact John Hancock directly at or online at forover-18.site Active participants on our. certify that I have reasonably concluded that the rollover check received by John Hancock USA with respect to the above participant makes a regular Roth (k). © John Hancock Life Insurance Company (U.S.A.) (John Hancock USA). All Roth (k) Rollover Contributions. Short: Medium: Long: TPA Source Code.

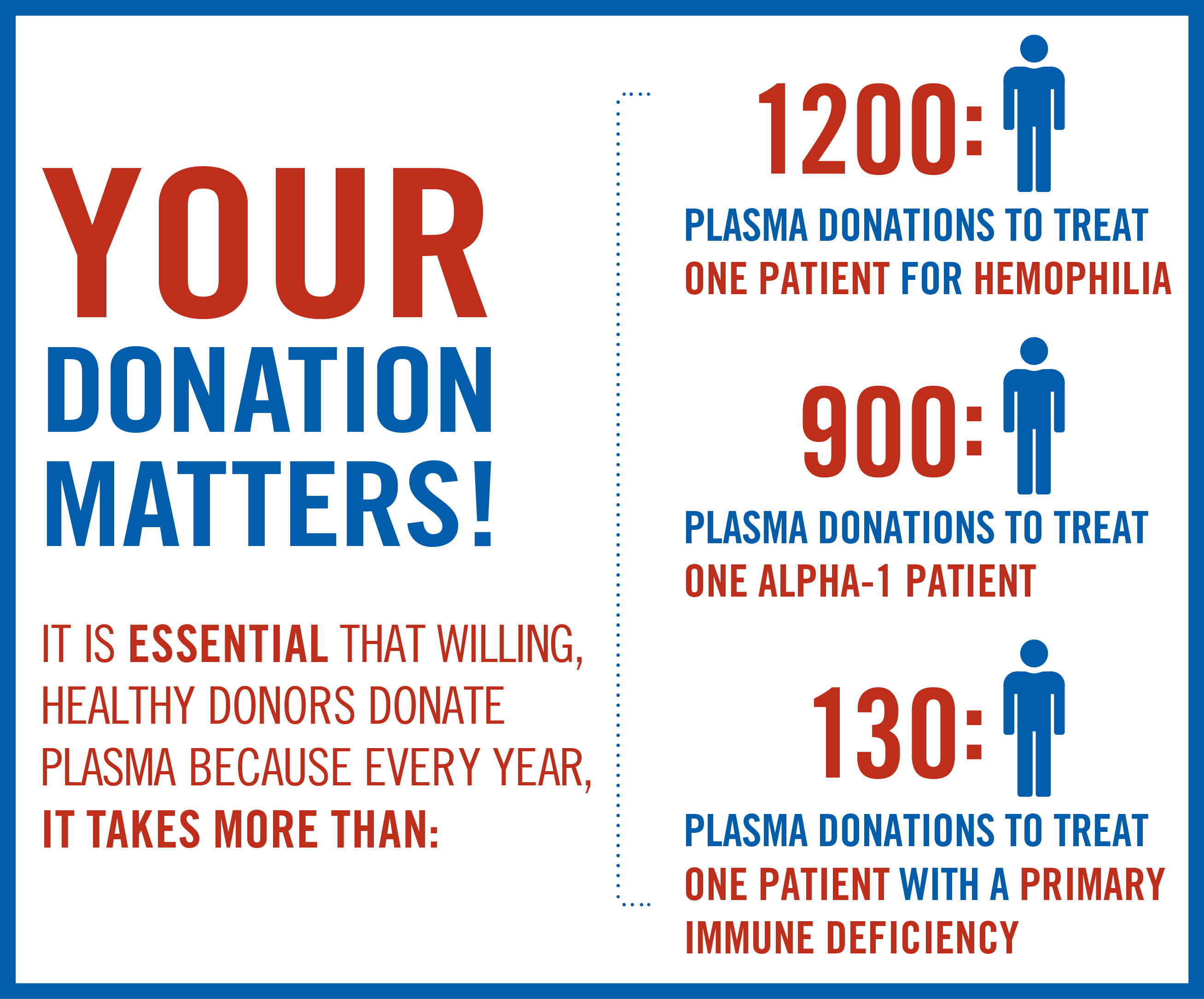

Donate Plasma Make Money

Compensation is based on appointment type, up to $ per collection appointment. What is a Health Screening or Prescreen appointment? Invite your family and friends to join our lifesaving cause by donating plasma. For every successful referral, you earn $! Read more. What our donors are. New Plasma Donors Can Earn Over $ During the First 35 Days! In addition to getting paid for each plasma donation, you can make even more money during special. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. Are you looking for paid plasma donation opportunities near Aurora, IL? Donate plasma for money at PlasmaSource. Schedule a donation appointment today. Earn up to $60 for each donation. All payments are digital transactions – no need to keep track of a physical card. Donate plasma today Talk with one of our donor specialists at or schedule an appointment today to make a plasma donation. New York Blood. Why not take my plasma from my whole blood donation? When you make a plasma donation, you donate approximately two to three times the amount of plasma than. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. Compensation is based on appointment type, up to $ per collection appointment. What is a Health Screening or Prescreen appointment? Invite your family and friends to join our lifesaving cause by donating plasma. For every successful referral, you earn $! Read more. What our donors are. New Plasma Donors Can Earn Over $ During the First 35 Days! In addition to getting paid for each plasma donation, you can make even more money during special. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. Are you looking for paid plasma donation opportunities near Aurora, IL? Donate plasma for money at PlasmaSource. Schedule a donation appointment today. Earn up to $60 for each donation. All payments are digital transactions – no need to keep track of a physical card. Donate plasma today Talk with one of our donor specialists at or schedule an appointment today to make a plasma donation. New York Blood. Why not take my plasma from my whole blood donation? When you make a plasma donation, you donate approximately two to three times the amount of plasma than. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers.

Need money now? We compensate every donor for the time they dedicate for each donation, since the process required can take anywhere from 1 to 2 hours. Plasma “donation” is NOT a “charitable donation” for income tax purposes. The compensation for your time spent “donating” is pay and is considered self-. Need money now? We compensate every donor for the time they dedicate for each donation, since the process required can take anywhere from 1 to 2 hours. life. Donate Plasma today! Hemarus is an FDA licensed facility specializing in life-saving source plasma collection. Our donors are kindly compensated and can. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Plasma for medicines. We use plasma donated at our plasma donor centres to make unique, life saving medicines, which can be used to treat over 50 diseases. Yes. Plasma donors are compensated for the commitment and efforts involved in being an important, regular plasma donor. Donors receive compensationon a pre-paid. From what I remember, the first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can be withdrawn. The donation compensation helps me support my kids and buy miscellaneous supplies for the house. Joel C. The reason I donate plasma is because of a near-. Donor Compensation. Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. However, since plasma donors receive a fnancial reward, plasma donation is considered a sale that yields taxable income. Page from regulation. It may. Bloodworks Northwest is a volunteer donor supported organization and does not pay for blood or plasma donations. FDA regulations do not permit compensation for. Today I'll be reviewing the side hustle of donating plasma and answering the question, is it worth the money, and what are the health risks. WHEN YOU RECEIVE PAYMENT FOR YOUR DONATION. Per the FDA those donations cannot be transfused into patients. Paid donations are used exclusively for further. Depending on the frequency of donations, individuals can expect to earn more than $ a month when donating plasma at the Miami Plasma Donor Center. This. Learn how to donate plasma for the first time. Find more about CSL's donor-focused plasma donation process, qualifications, and how to get compensated. Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need.

How To Take Overdraft Protection Off Bank Of America

To help you avoid fees, we won't authorize ATM withdrawals or everyday debit card purchases when you don't have enough money in your account at the time of the. You can contact your bank to find out how to revoke consent. Your decision to revoke your consent does not require that the bank waive or reverse any overdraft. Balance Connect® for overdraft protection can help you cover your payments and purchases by automatically transferring available money from your eligible. Get Answers to Your Banking Questions · Glossary · Non-Sufficient Funds (NSF) Fees & Overdraft Protection. NorthCoast 99 award - Best Workplaces in Northeast Ohio! #1 credit union in Ohio according to Forbes! Newsweek's America's BEST regional banks. Log in to BMO Digital Banking and modify your overdraft preferences within the "Account preferences" section · Use the BMO Bank by Phone self-serve option by. Looks like BOA switched to overdraw protection that is loan payable in 3 months with 5 dollar fee only no interest. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. It's "off" by default. You have to give positive consent in writing to enable overdraft protection on a bank account. If you didn't do that and. To help you avoid fees, we won't authorize ATM withdrawals or everyday debit card purchases when you don't have enough money in your account at the time of the. You can contact your bank to find out how to revoke consent. Your decision to revoke your consent does not require that the bank waive or reverse any overdraft. Balance Connect® for overdraft protection can help you cover your payments and purchases by automatically transferring available money from your eligible. Get Answers to Your Banking Questions · Glossary · Non-Sufficient Funds (NSF) Fees & Overdraft Protection. NorthCoast 99 award - Best Workplaces in Northeast Ohio! #1 credit union in Ohio according to Forbes! Newsweek's America's BEST regional banks. Log in to BMO Digital Banking and modify your overdraft preferences within the "Account preferences" section · Use the BMO Bank by Phone self-serve option by. Looks like BOA switched to overdraw protection that is loan payable in 3 months with 5 dollar fee only no interest. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. It's "off" by default. You have to give positive consent in writing to enable overdraft protection on a bank account. If you didn't do that and.

Overdraft protection is an optional bank account service that prevents the rejection of charges that are in excess of available funds. If you bring your available balance to at least $0, we will not assess any Overdraft Fees. If you do not use Extra Time to make a deposit, or if your deposit is. You can opt out of the service at any time by contacting our Care Center at or visiting a financial center. Please note this request could take. WHAT YOU NEED TO KNOW ABOUT OVERDRAFTS, OVERDRAFT FEES AND HOW TO AVOID THEM. · Log in to Online Banking and denote your ATM/Debit Card Overdraft Settings, or. An overdraft happens when your checking account does not have enough funds to cover a purchase or payment. Discover how you can help avoid overdraft fees. The Additional Overdraft Privilege is not provided unless your account qualifies for, and you have not opted out of, the Standard Overdraft Privilege. For. Use this and other information to evaluate your overdraft protection experience. Banks are flexible and will help you if you want to change your choice about. If you do opt-in for overdraft protection or coverage, then your bank may While you have a choice to opt-in or opt-out of overdraft coverage for. Recipients of federal or state benefits payments who do not wish us to deduct the amount overdrawn and the Overdraft Item Fee from funds that you deposit or. Online banking · Select the account you want to use. · Click the Financial Details button at the top of your screen. You might have to click More first. · To the. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. Overdraft Protection transfers are an option when you have a savings, money market or personal line of credit account linked to your checking account. Simply. For all options, bounced paper checks (which occur if you write a check and don't have enough money in your bank account to cover the amount) incur a $9. With Courtesy Pay, you get added protection, as debit/ATM transactions that result in negative balances are also covered. Plus, Courtesy Pay can kick in if you. Write a check, use your debit card, make an ATM withdrawal, or perform any You don't have to remember to make a payment - First American will pay off any. Savings Overdraft Protection · No transfer fees. Choose this optional service to link your checking account1 with a savings account · Cover transactions up to. How do I opt in or out of courtesy pay? You can easily opt out (or back in) on the members 1st mobile app, online banking, by phone at () or at. or contact us through Online Banking at forover-18.site You have the right to revoke your consent at any time. YOUR CHECKING ACCOUNT BALANCE. Your. With this setting you can avoid Overdraft Item Fees. • Checks or scheduled payments will be returned unpaid if you don't have enough money in your account. • If. Online banking: Select your checking account and choose Account services. · Select Overdraft resources, then choose Overdraft coverage. · Choose Change coverage.

How Can You Put Yourself Up For Adoption

Public agency services are usually free or very low cost—and often reimbursable. · Private adoption agencies guide you through the adoption process in much the. You can't give yourself up for adoption. You can see if you have a relative, or a close friend's parents, who would be willing to take you in. The answer to your question isn't necessarily, “No.” However, teenage adoption is rare, especially in a private domestic adoption. yourself and your child. Our counselors will be with you every step put-baby-up-for-adoptionpx. I'm proud of myself for choosing adoption for my son. In the adoption process of a teenager, there is the added legal element of consent. In newborn adoptions, the birth mother must give her consent to the adoption. Age Requirements: Generally, the adopter and the adoptee must both be over the age of · Consent: Both parties must consent to the adoption, and it usually. Contact a local parent or adoption support group. You can find groups through online searches, resources at your obstetrician's office, or through a. If you're exploring adoption for a toddler or young child, you can reach an Adoptions Together counselor via email, text message, online chat or a confidential. I am going to write a letter to Colton explaining my reasons for choosing adoption and to let him know that I will always love him no matter what. I think that. Public agency services are usually free or very low cost—and often reimbursable. · Private adoption agencies guide you through the adoption process in much the. You can't give yourself up for adoption. You can see if you have a relative, or a close friend's parents, who would be willing to take you in. The answer to your question isn't necessarily, “No.” However, teenage adoption is rare, especially in a private domestic adoption. yourself and your child. Our counselors will be with you every step put-baby-up-for-adoptionpx. I'm proud of myself for choosing adoption for my son. In the adoption process of a teenager, there is the added legal element of consent. In newborn adoptions, the birth mother must give her consent to the adoption. Age Requirements: Generally, the adopter and the adoptee must both be over the age of · Consent: Both parties must consent to the adoption, and it usually. Contact a local parent or adoption support group. You can find groups through online searches, resources at your obstetrician's office, or through a. If you're exploring adoption for a toddler or young child, you can reach an Adoptions Together counselor via email, text message, online chat or a confidential. I am going to write a letter to Colton explaining my reasons for choosing adoption and to let him know that I will always love him no matter what. I think that.

Your first step, like always, is to start by calling our agency at ADOPTION. There, an adoption specialist will walk you through the process of creating. The short answer is “yes.” Many adoption agencies that specialize in domestic infant adoption can also work with parents who want to place their toddler for. Educating yourself, contacting an agency, and attending an orientation meeting are the first steps toward adopting and/or fostering. At the age of 20 I think that you might be a little too old to be put up for adoption because you are a adult and not a minor. What to Know about How to Place an Older Child Up for Adoption · Work With a Licensed Agency · Avoid Adoption Facilitators · Mediated Contact With the Birth Father. When putting an older child up for adoption, it's crucial to take factors such as the child's medical history, who has had primary custody, the involvement of. Putting a child up for adoption at 16 could be the best response to your unplanned pregnancy. Your other options — parenting and abortion — are also possible. Most private adoption agencies are not equipped to handle the placement of an older child. The best option for you could be to reach out to a social service. The first step is to contact A Child's Hope for more information about putting up your child for adoption. An adoption counselor will reach out to you to learn. If you want to adopt someone who is 18 or older (the adult), you may be able to do so through the adult adoption process. At many adoption agencies, including American Adoptions, 4 years old is generally considered the maximum age to put a child up for adoption. Instead, seeking. Until then, continue reading to learn more about “giving a child up” for adoption who is ages 5 to 5 Years. For the most part, private adoption agencies'. For a child to be legally adopted, the child's parents must legally relinquish their rights to the child by formally signing consent to the adoption. Before. Depending on the laws in your state, you could get help with bills, groceries, counseling, and more. Your adoption professional will work with you to put. Can you put a baby up for adoption in Arizona? Anyone can choose adoption giving yourself new opportunities). So, if you were wondering, “Can you put a. Fill out our online contact form or call us at ADOPTION to get more free information now. We're here to help you at any time. “Giving Children Up” for. DOH Adoption Information Registry Birth Parent Registration Form. PDF ; OCFS NYS OCFS Request/Response for Name and/or address of Father of Child. You would have to file for emancipation to be free from your family but that would involve you being able to provide wholey for yourself. The father at that point may have the right to sue for custody of his child. There are things a mother can do if she wishes to put her child up for adoption. Children awaiting adoption from the foster care system have usually been made available because of court ordered termination of parental rights. Once their.

Can Bank Loan Money

Looking to consolidate debt or fund a major purchase? Current U.S. Bank customers with credit approval can borrow up to $50, with our personal loan. Learn. loan, with funds deposited directly into your bank account. No credit What is the minimum and maximum amount of money I can request for My Chase Loan? A national bank may make, sell, purchase, participate in, or otherwise deal in loans and interests in loans that are not secured by liens on, or interests in. A personal loan can either be secured or unsecured. With a secured loan, you can pledge collateral, such as cash, stocks or bonds, in the event you may not meet. Automated Clearinghouse (ACH): An electronic funds transfer network that enables direct money transfers between participating bank accounts and lenders. This. Banks will loan money to businesses on the basis of an adequate return for their investment, to reflect the risks of defaulting and to cover administrative. Whether you want to stay in your home or sell, you can use a personal loan to fund home remodeling, repairs or upgrades. Learn more. Cash wrapped as a gift. No Bank will give loan for the purpose of buying a Bank. Further, no Bank is there for sale. Further, borrowed money cannot be used for purchase of shares of. Banks have limits on how much of their portfolio can be lent to a single borrower (this also means a group of legally independent entities if. Looking to consolidate debt or fund a major purchase? Current U.S. Bank customers with credit approval can borrow up to $50, with our personal loan. Learn. loan, with funds deposited directly into your bank account. No credit What is the minimum and maximum amount of money I can request for My Chase Loan? A national bank may make, sell, purchase, participate in, or otherwise deal in loans and interests in loans that are not secured by liens on, or interests in. A personal loan can either be secured or unsecured. With a secured loan, you can pledge collateral, such as cash, stocks or bonds, in the event you may not meet. Automated Clearinghouse (ACH): An electronic funds transfer network that enables direct money transfers between participating bank accounts and lenders. This. Banks will loan money to businesses on the basis of an adequate return for their investment, to reflect the risks of defaulting and to cover administrative. Whether you want to stay in your home or sell, you can use a personal loan to fund home remodeling, repairs or upgrades. Learn more. Cash wrapped as a gift. No Bank will give loan for the purpose of buying a Bank. Further, no Bank is there for sale. Further, borrowed money cannot be used for purchase of shares of. Banks have limits on how much of their portfolio can be lent to a single borrower (this also means a group of legally independent entities if.

What would you like the power to do? For you and your family, your business and your community. At Bank of America, our purpose is to help make financial. Can you get two loans from the same bank? Yes. Many banks and lenders will allow you to take out more than one loan, but they typically have limits. These are. Put your home's equity to work and gain easy, flexible access to a revolving line of credit and pay interest only on the amount you borrow. The loan can go. You can rest easy knowing you're getting a loan at a low rate (meaning you save money) and that's fixed (so it will never adjust). We keep it simple! Compass. Banks offer a variety of ways to borrow money, including mortgage products, personal loans, auto loans, and construction loans. With a personal loan, you will need to know upfront how much money you want to borrow. When you apply for a personal loan, you receive a fixed amount of money. No, the bank's ability to create money is dependent on them having sufficient flows of incoming credit to offset their own bank credit flowing. Whether your needs are large or small, we offer personal loan and line of credit options with fast and easy access to money for what matters to you. Loan. Home Equity Loans. Central Bank's Platinum Equity Line4 lets you turn the equity you have in your home into cash for the things you want – from home. What will I pay in all? Like other loans, personal loans usually charge interest rates and fees. In addition to paying back what you borrow, you can expect to. What can a personal loan be used for? Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or. That's where personal loans can come in. The money you borrow gets repaid to the lender in smaller, fixed monthly installments (with interest, of course). So. A debt consolidation loan up to $40, to pay off credit card debt or personal loan balances, with the option to get extra cash. Check Your Rate. Cash Loan. A. Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or consolidating debt, all with one fixed. Usually, yes, if allowed under the terms of your deposit account agreement and loan contract. Generally, a bank may take money from your deposit account to. A Carter Bank Personal Loan can provide you with funds to pay off credit cards, cover medical bills or make a special purchase. A personal loan can be a powerful financial tool for accomplishing your goals. Used wisely, a personal loan can be a great way to make large purchases, save. A personal loan can give you the financial flexibility to take on nearly anything you want to do next in life. Maybe you're ready to start home renovations. Or. If you don't have that laid out in writing just yet, there are plenty of free resources that you can use, including local Small Business Development Centers.