forover-18.site News

News

Banks Like Capital One 360

An outgoing domestic wire transfer is $ If you present us with a foreign check, we will not charge a fee, but the paying bank may deduct a fee from the. Capital One Financial Corporation is an American bank holding company founded on July 21, and specializing in credit cards, auto loans, banking. Bankrate's picks for the top free checking accounts ; Discover Bank · Best for: Cash back rewards and no fees ; NBKC Bank · Best for: High yield ; Ally Bank · Best. Personal Picks: ✓Ally Bank (forover-18.site): No-fee savings account, has solid Interest rates & works great. ✓Capital One (http://. Bankrate's picks for the top free checking accounts ; Discover Bank · Best for: Cash back rewards and no fees ; NBKC Bank · Best for: High yield ; Ally Bank · Best. Capital One Checking Account · Chase Secure Banking Account · Colony Bank Colony One Checking Want to join the Bank On movement and offer your. Capital One Checking Account; NBKC Everything Account; Chase Total Checking; PNC Bank. Axos Rewards Checking. Useful for, Fees and APY¹. Anyone meeting the. If you judge solely on interest rates, Capital One is the overall better option for banking due to its % (as of 06/26/24) APY on the Capital One Capital One Checking Account · Chase Secure Banking Account · Colony Bank Colony One Checking Want to join the Bank On movement and offer your. An outgoing domestic wire transfer is $ If you present us with a foreign check, we will not charge a fee, but the paying bank may deduct a fee from the. Capital One Financial Corporation is an American bank holding company founded on July 21, and specializing in credit cards, auto loans, banking. Bankrate's picks for the top free checking accounts ; Discover Bank · Best for: Cash back rewards and no fees ; NBKC Bank · Best for: High yield ; Ally Bank · Best. Personal Picks: ✓Ally Bank (forover-18.site): No-fee savings account, has solid Interest rates & works great. ✓Capital One (http://. Bankrate's picks for the top free checking accounts ; Discover Bank · Best for: Cash back rewards and no fees ; NBKC Bank · Best for: High yield ; Ally Bank · Best. Capital One Checking Account · Chase Secure Banking Account · Colony Bank Colony One Checking Want to join the Bank On movement and offer your. Capital One Checking Account; NBKC Everything Account; Chase Total Checking; PNC Bank. Axos Rewards Checking. Useful for, Fees and APY¹. Anyone meeting the. If you judge solely on interest rates, Capital One is the overall better option for banking due to its % (as of 06/26/24) APY on the Capital One Capital One Checking Account · Chase Secure Banking Account · Colony Bank Colony One Checking Want to join the Bank On movement and offer your.

Compare the Top Online Banks · Ally Bank · Capital One · Discover Bank · Axos Bank · SoFi.

Most, like Discover® Bank, Ally, Axos, and Capital One, offer the same easy electronic access to your money but also have additional options that Chime doesn't. One of the best online banks like Chime is definitely Capital One It offers a ton of great features. Capital One offers a number of accounts, including. Checking · BMO is offering $ Cash Bonus when you open a Personal Checking account. see full details · Bank of America gives you $ when you open an. But why not bank with a bank like capital one that doesn't have any fees? I'm curious about what they bring to the table that makes their. No monthly fees, no minimums and no overdraft fees. Open account 24/7 mobile banking. Access your money & bank almost anywhere with our top-rated mobile app. Our Top Picks · SoFi · Lake Michigan Credit Union · Alliant Credit Union · BMO · Ally Bank · Axos Bank · Capital One. When you set up free direct deposit, you may receive your money up to 2 days forover-18.site have three options to choose from if you want overdraft service: Auto-. What's on the Capital One Mobile app? All of your accounts, and so much more. Whether you're out in the world or feeling right at home, you can manage your. Like brick-and-mortar banks, online banks can offer FDIC-insured Options include: Capital One Checking Account, Chime® Second Chance Banking. Best Online Banks. Capital One Checking. Minimum opening deposit: None. Monthly fee: None. ATMs: 70, Uses ChexSystems: No. Though it's technically. Capital One , Discover, Alliant Credit Union, Fidelity CMA, Schwab, Ally and Sofi seem to be the most commonly cited free online accounts on. With features like Citizens Paid Early™ which lets you get paid sooner—up to 2 days early Blank image. One Deposit Checking from. Axos Rewards Checking · Varo Online Checking Account · Ally Interest Checking Account · Discover Checking Account · Chime Spending Account · Capital One Checking. Dishonest bank. I filed a dispute regarding a double charge on my Capital One debit card. Jan 10 I had funds in my acct $85 to. Discover business banking products, resources and convenient digital tools to move your business forward. Find out how to put our business bank accounts. The Capital One ATM network offers checking customers free access to Capital One, MoneyPass® and Allpoint® ATMs. Fee-free ATM access is limited to consumer and. Online Accounts: ; Retail Branch Accounts: For your security, please do not enter any personal information such as account. American Express National Bank; Alliant Credit Union; CIT Bank; GO2Bank; Quontic; Discover; Ally; EverBank; Capital One ; Axos; LendingClub; Varo Bank. Fees may be charged for certain transactions such as wire transfers and cashier's checks. Visit Checking Account disclosures for more details. The. Capital One. Checking. Remove Bank. Fifth Third. Momentum Checking. 1% cash Choose up to 3 banks you'd like to compare. The non-Discover Bank.

What Is Alimony Mean

As a general rule, debts may not be incurred to defeat alimony. The length of the marriage, meaning the number of years from the day on which the parties are. Under Georgia law, alimony is available to those who are in financial need after the divorce case is over. Alimony is essentially spousal support, some. Alimony refers to the financial assistance and monetary support provided by one spouse to another after a marriage ends in divorce. Alimony, also known as spousal support, consists of payments that one spouse makes to the other person after their divorce is final to maintain the same. It is not punitive, meaning it is not intended to punish a spouse for causing the divorce or misbehaving during the marriage. Marital misconduct has no impact. Speak with an experienced Florida alimony lawyer who will protect your interests. Call to schedule a confidential case review today. Alimony is court-ordered support paid by one spouse to the other for a period of time after a divorce. When people think of payments made to an ex-spouse, they typically think of alimony. Alimony, if appropriate, is awarded by the court or negotiated as part of a. An alimony payment is a periodic predetermined sum awarded to a spouse or former spouse following a separation or divorce. As a general rule, debts may not be incurred to defeat alimony. The length of the marriage, meaning the number of years from the day on which the parties are. Under Georgia law, alimony is available to those who are in financial need after the divorce case is over. Alimony is essentially spousal support, some. Alimony refers to the financial assistance and monetary support provided by one spouse to another after a marriage ends in divorce. Alimony, also known as spousal support, consists of payments that one spouse makes to the other person after their divorce is final to maintain the same. It is not punitive, meaning it is not intended to punish a spouse for causing the divorce or misbehaving during the marriage. Marital misconduct has no impact. Speak with an experienced Florida alimony lawyer who will protect your interests. Call to schedule a confidential case review today. Alimony is court-ordered support paid by one spouse to the other for a period of time after a divorce. When people think of payments made to an ex-spouse, they typically think of alimony. Alimony, if appropriate, is awarded by the court or negotiated as part of a. An alimony payment is a periodic predetermined sum awarded to a spouse or former spouse following a separation or divorce.

Alimony is not necessary in every case. In Georgia, there is no formula or calculation for determining alimony. The court will weigh out the parties' "needs" vs. Alimony, also referred to as spousal support or maintenance, is money paid by one spouse to the other after they legally separate or divorce. Alimony is generally defined as financial assistance provided by one spouse to another, during and after a divorce. In Florida, either a husband or a wife may. If divorce means one spouse will stay at the marital standard of living and the other won't, the judge may use spousal support to even things out. Whether. Alimony is financial support paid by one ex-spouse to the other after the marriage has legally ended. Alimony is also sometimes called spousal support. alimony: An allowance for support made under court order to a divorced person by the former spouse, usually the chief provider during the marriage. Spousal support is an amount of money that the court orders one spouse to pay to the other spouse for his or her reasonable needs. The purpose of alimony is to limit any unfair economic effects of a divorce. It provides continuing income to a spouse who has little or no pay. Alimony or spousal support is the payment of money by one spouse to the “No-fault divorce” means that either party can file for divorce without the. This means it is ordered for as long as it takes for the recipient spouse to receive the education or job training to be self-supportive. Reimbursement or. Alimony definition: an allowance paid to a person by that person's spouse or former spouse for maintenance, granted by a court upon a legal separation or a. Spousal support (also known as alimony) is a court ordered payment from one spouse or domestic partner to help cover the other's monthly expenses. States use different terms for alimony, such as spousal support and maintenance, but they usually mean essentially the same thing. And state laws on alimony. Alimony is generally ordered by the court as a means to provide financial support to the spouse who has a lower income, or no income at all, during a separation. Reserve spousal support - this means that the court is not ordering support now. But, it could in the future. So, support is $0 now but could be changed at a. When a couple gets divorced, the court might order the one spouse to pay alimony to the other, which is like an allowance for basic expenses like food and. Spousal support, or alimony, is financial assistance determined by a divorce decree. This support recognizes a partner's contribution to the marriage, and helps. It is designed to provide financial support during the divorce process itself and is typically granted to the lower-earning spouse. Permanent. Permanent alimony. The alimony definition refers to the legal obligation of the higher-income spouse to provide financial support to the lower-income spouse during a legal. That means that payments are made to the other spouse that last as long as the person paying or the person getting paid is alive or remarries. Permanent alimony.

Index Funds What Is It

:max_bytes(150000):strip_icc()/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png)

Index fund An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate. An index fund is a type of passive mutual fund that aims to mirror the performance of a specific market index. Instead of relying on active fund managers to. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Index funds are part of the broad range of investment products called mutual funds. Like cooks making a stew, mutual fund managers add shares of various stocks. ETFs and index funds can both be tax efficient – in part because there's generally low turnover in these funds – but ETFs may have a slight edge because of the. Fidelity now offers the Fidelity ZERO Total Market Index Fund (FZROX), Fidelity ZERO International Index Fund (FZILX), Fidelity ZERO Large Cap Index Fund (FNILX). We discuss how index funds work, identify some indexes these funds track, and examine benefits and risks associated with index fund investing. Fidelity now offers the Fidelity ZERO Total Market Index Fund (FZROX), Fidelity ZERO International Index Fund (FZILX), Fidelity ZERO Large Cap Index Fund (FNILX). Index investing allows you to put money in the largest U.S. companies with low fees and minimal risk. Select breaks down how they work. Index fund An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate. An index fund is a type of passive mutual fund that aims to mirror the performance of a specific market index. Instead of relying on active fund managers to. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Index funds are part of the broad range of investment products called mutual funds. Like cooks making a stew, mutual fund managers add shares of various stocks. ETFs and index funds can both be tax efficient – in part because there's generally low turnover in these funds – but ETFs may have a slight edge because of the. Fidelity now offers the Fidelity ZERO Total Market Index Fund (FZROX), Fidelity ZERO International Index Fund (FZILX), Fidelity ZERO Large Cap Index Fund (FNILX). We discuss how index funds work, identify some indexes these funds track, and examine benefits and risks associated with index fund investing. Fidelity now offers the Fidelity ZERO Total Market Index Fund (FZROX), Fidelity ZERO International Index Fund (FZILX), Fidelity ZERO Large Cap Index Fund (FNILX). Index investing allows you to put money in the largest U.S. companies with low fees and minimal risk. Select breaks down how they work.

An index fund aims to match the performance of a market index by building a portfolio that invests in all / part of the constituent securities of the index. The major difference between index funds and ETFs is their trading mechanism and flexibility. Index funds can only be bought and sold at the end of the trading. Risk Mitigation. Given some of the issues with index funds, there are some things investors can do to protect themselves. This is the least sexy approach, but. What are index funds? Index investment funds are collective investment undertakings whose investment policy strives to mimic a certain index. For example, an. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. The S&P Index, the Russell Index. Index investing is a passive investment method achieved by investing in an index fund. An index fund is a fund that seeks to generate returns from the broader. Since index funds track a market index and are passively managed, they are less volatile than the actively managed equity funds. Hence, the risks are lower. Schwab ®. This index tracks 1, of the largest publicly traded U.S. companies, offering investors exposure to 90% of the total U.S. stock market. It's. Copy That. An index fund is a professionally managed collection of stocks, bonds, or other investments that tries to match the returns of a specific index, such. The major difference between index funds and ETFs is their trading mechanism and flexibility. Index funds can only be bought and sold at the end of the trading. Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is. An "index fund" describes a type of mutual fund or unit investment trust (UIT) whose investment objective typically is to achieve approximately the same. Index funds tend to be low cost since they don't require as much effort on the part of the fund manager in choosing what securities to buy and sell. But index. An index fund tracks the performance of a specific market index. It invests in the same securities as the underlying index to replicate its performance. Because. An index fund aims to match the performance of a market index by building a portfolio that invests in all / part of the constituent securities of the index. Index funds are simple, low-cost ways to gain exposure to markets. They're most commonly available as mutual funds and exchange traded funds (ETFs). While. Defining the future of indexing to help achieve the investment outcomes you want. Since launching index funds in the 's, BlackRock has become a global. Index funds are investments that follow an index. Their main goal is to make a portfolio that looks like an index of the stock market. A fund that tracks an. ETFs, vehicles which specifically aim to replicate an index, have been steadily gaining market share in Europe. Currently, about 12% of assets are invested in. A stock index is a hypothetical portfolio of stocks - a list of names and numbers of shares - selected according to some established criteria. An index fund is.

Kiyosaki Silver

I'm a Rich Dad / Kiyosaki fan but I'm also very realistic This book as described in the title of my review is one where the author attempts to write a good. In his book “Fake,” Kiyosaki examines the future of money and claims that Learn everything you need to know about silver price forecasts and. In , I'm a year-loldkid. I start collecting real silver coins. And then, in '72 I become a pilot in Vietnam. I went behind enemy lines to find out how. Robert Kiyosaki (Rich Dad Poor Dad) offers personal finance education to help you learn about cash flow, real estate, investing, and business building. From direct purchases of precious metal coins and bars to Precious Metal IRAs. Our team can help make your gold and silver investment easy, seamless, and secure. Robert Kiyosaki Urges Investors: Embrace Bitcoin, Gold, and Silver to Safeguard Against Looming Inflation · Gold's Resurgence and the Call for. Want to thank Smart Silver Stacker for laughing at me for recommending people buy and save silver since Silver' · Lear Capital TV Spot, 'Robert Kiyosaki: $5, in Bonus Silver' - Lear Capital TV Spot, 'Robert Kiyosaki: $5, in Bonus Silver' · Lear Capital. BEST INVESTMENT for decade is Silver. Started recommending US silver eagles at $ Today $ Everyone can still afford. I'm a Rich Dad / Kiyosaki fan but I'm also very realistic This book as described in the title of my review is one where the author attempts to write a good. In his book “Fake,” Kiyosaki examines the future of money and claims that Learn everything you need to know about silver price forecasts and. In , I'm a year-loldkid. I start collecting real silver coins. And then, in '72 I become a pilot in Vietnam. I went behind enemy lines to find out how. Robert Kiyosaki (Rich Dad Poor Dad) offers personal finance education to help you learn about cash flow, real estate, investing, and business building. From direct purchases of precious metal coins and bars to Precious Metal IRAs. Our team can help make your gold and silver investment easy, seamless, and secure. Robert Kiyosaki Urges Investors: Embrace Bitcoin, Gold, and Silver to Safeguard Against Looming Inflation · Gold's Resurgence and the Call for. Want to thank Smart Silver Stacker for laughing at me for recommending people buy and save silver since Silver' · Lear Capital TV Spot, 'Robert Kiyosaki: $5, in Bonus Silver' - Lear Capital TV Spot, 'Robert Kiyosaki: $5, in Bonus Silver' · Lear Capital. BEST INVESTMENT for decade is Silver. Started recommending US silver eagles at $ Today $ Everyone can still afford.

Here's a look at what Kiyosaki prefers instead. Precious Metals. Over the centuries, precious metals — particularly gold and silver — have been a popular hedge. Happened: Kiyosaki expressed his doubts about Bitcoin ETFs, stating his reluctance to invest in them. He compared them to gold and silver ETFs, arguing that. Best Director Silver Lion, Wife of a Spy, Won. 29th Busan International Film Festival, , Best Director Silver Lion, The Asian Filmmaker of the Year, Won. Today, Robert Kiyosaki shared a post via his X account, addressing the fact He advised traders to buy more crypto, along with gold and silver. Robert Kiyosaki: Silver is more valuable than real estate! Outlined is a game plan for converting precious metals into real estate at the. Silver. from: $ · The Housemaid Is Watching. Freida McFadden. from: $ Robert T. Kiyosaki. from: $ · Beloved. Toni Morrison. from: $ Robert Kiyosaki is a financial educator, author, and businessman who believes in investing in assets that have the potential to hold value. Guide to Investing in Gold and Silver Audiobook By Michael Maloney, Robert Kiyosaki - foreword. Sample. Guide to Investing in Gold and Silver. Protect Your. In addition to the topics of the U.S. going bankrupt, precious metals, and more, Jim shares the incredible story of his historic silver trades with the Hunt. 'Rich Dad' Robert Kiyosaki Says Silver Is the Biggest Investment Bargain Right Now. Robert Kiyosaki talks about his first investment and why he prefers to buy gold and silver coins. Don't forget to follow us on Instagram - @SimpleMoneyLyfe. Robert Kiyosaki is the author of the number one biggest-selling personal finance book of all time, Rich Dad, Poor Dad. Rich Dad, Poor. Robert Kiyosaki is the author of the number one biggest-selling personal finance book of all time, Rich Dad, Poor Dad. Rich Dad, Poor. Kiyosaki likes silver, too. In fact, he recently tweeted “Silver best investment in Oct ” and “Everyone can afford $20 silver.” To be. Happened: Kiyosaki expressed his doubts about Bitcoin ETFs, stating his reluctance to invest in them. He compared them to gold and silver ETFs, arguing that. Here's a look at what Kiyosaki prefers instead. Precious Metals. Over the centuries, precious metals — particularly gold and silver — have been a popular hedge. Recently, he tweeted that “silver is the best, lowest risk high potential investment.” According to Kiyosaki, silver currently offers the best investment value. What Are Examples of Assets? Personal assets can include a home, land, financial securities, jewelry, artwork, gold and silver, or your checking account. Why investing in gold, silver, oil or gas may (or may not) be your best option forover-18.site #financialeducation #gold. If you pay attention to financial media you've probably heard of “Rich Dad, Poor Dad.” The author, Robert Kiyosaki, has made a killing selling books and.

I Need To Make A Lot Of Money

As one progresses through the game, many efficient ways to make money become available. Also, if you have a large amount of large fish (for example, from. Being a virtual assistant is a steller side hustle for people who want to work from wherever. As long as you have connectivity, you can be in business! Hustle #. How to make money fast · Find out if you have unclaimed property · Sell unused gift cards · Trade in old electronics · Take surveys · Sell clothes and accessories. Timed departures from multiple locations across LA County · In advance online: $7 + $ per ticket fee round-trip · Day-of at the lot: $12 (cash only with exact. forover-18.site, protect your savings by ditching the fiat money system and investing SOME of it into gold and especially silver. · 2. Identify the. Conclusion. You don't need talent to make a lot of money. Instead, you need the courage to dare go to places you are unfamiliar with to find out. Thank you for all you do. I'll be frequenting here a lot. Reply. Financial Samurai. But what if I told you it was possible to make thousands of dollars each month just by selling eBooks? Ebooks, on the other hand. need a lot of them. Which are the top trade-in sites? Here's a list of the main players. They have been chosen based on feedback from the forum – if you've. As one progresses through the game, many efficient ways to make money become available. Also, if you have a large amount of large fish (for example, from. Being a virtual assistant is a steller side hustle for people who want to work from wherever. As long as you have connectivity, you can be in business! Hustle #. How to make money fast · Find out if you have unclaimed property · Sell unused gift cards · Trade in old electronics · Take surveys · Sell clothes and accessories. Timed departures from multiple locations across LA County · In advance online: $7 + $ per ticket fee round-trip · Day-of at the lot: $12 (cash only with exact. forover-18.site, protect your savings by ditching the fiat money system and investing SOME of it into gold and especially silver. · 2. Identify the. Conclusion. You don't need talent to make a lot of money. Instead, you need the courage to dare go to places you are unfamiliar with to find out. Thank you for all you do. I'll be frequenting here a lot. Reply. Financial Samurai. But what if I told you it was possible to make thousands of dollars each month just by selling eBooks? Ebooks, on the other hand. need a lot of them. Which are the top trade-in sites? Here's a list of the main players. They have been chosen based on feedback from the forum – if you've.

You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1, thanks to zero-fee brokerages and. create a $ emergency fund and still have money left over. Commit to lots of money in the long-term. Weatherproof your home. Caulk holes. Care for a child who gets TANF. Are 25 or older. Do not have a lot of money or have a way to get more money. Maximum Monthly Income Limits. While there is a lot of money to be made in the movie business, ticket sales alone are not enough. Learn the economics of movie making. They, too, have made a significant impact with their work and talents, it's just not reflected in their net worth. They chose to chase something else instead. I. How to make money fast · Find out if you have unclaimed property · Sell unused gift cards · Trade in old electronics · Take surveys · Sell clothes and accessories. need a lot of them. Which are the top trade-in sites? Here's a list of the main players. They have been chosen based on feedback from the forum – if you've. 8 simple ways to save money. Saving is easier when you have a plan—follow these steps to create one. Read, 5 minutes. Sometimes the hardest thing about saving. We do not accept cash. The parking lot will be closed once it reaches capacity. Call () before heading to the park to make sure lot is not full. If paying cash, you must use a kiosk.) Covered parking; 16 EV Charge need help getting to or from their gate. (Please coordinate wheelchair or. If you make a lot of money, you need to keep track of what you have to do. In fact, Corley found that 81% of the wealthy maintain a to-do list and actually. you don't need to be a world-famous rock star to earn a lot of money in the music business. Being famous and earning a lot of money are often very different. Airbnb is a site that allows you to list your home (or just a room) for other people who may just want to visit where you live. You can list it as often as you. To make money with affiliate marketing, you'll need to identify a product So be prepared to spend a lot of time, rather than a lot of money, at the start of. You can exchange the points for cash or, more often, gift cards, specific products, and coupons. Taking surveys online isn't the best way to make a lot of money. Fortunately, you have a variety of options when it comes to making money. Doing odd jobs is a quick and easy way to earn money. Similarly, reselling items or. If you want to make a lot of money perhaps you should first ask yourself this critical question which could dramatically alter the way you think about your. 30 Top Earning Websites That Make A Lot Of Money Online. Click To Share on We have tried so many different ways to earn money from the internet. In. If you guys want to make money, know that it is very straightforward. There's no magic formula. You just simply have to want to do it and create enough scale. If you do not absolutely need accessible parking- please park in the general lots. For fans that wish to use cash, Cash to Card conversion will be.

Gas Prices Fall

20 minutes ago. Seasonal increases in demand plus a transition to unique fuel blends put pressure on gas prices each spring. Since , gasoline prices have increased about U.S. Regular Gasoline Prices*(dollars per gallon) full history XLS. Change from. 08/05/24, 08/12/24, 08/19/24, week ago, year ago. U.S., , , A new analysis published this week shows that gas prices could fall Thanks to stable oil prices and little change in demand, gas prices are continuing to fall. Anything that has to be shipped or transported—from apples to electronics—could cost more as gas prices rise. This is especially true for products, or. Gasoline prices are generally lower in winter months. Gasoline specifications and formulations also change seasonally. Environmental regulations require that. The average gas price per gallon in was $, peaking in August and September before falling to its lowest point in December. The highest average gas. The average gas price per gallon in was $, peaking in August and September before falling to its lowest point in December. The highest average gas. Thanks to stable oil prices and little change in demand, gas prices are continuing to fall. Drop in fuel demand and oil prices sends gas prices lower: AAA. 20 minutes ago. Seasonal increases in demand plus a transition to unique fuel blends put pressure on gas prices each spring. Since , gasoline prices have increased about U.S. Regular Gasoline Prices*(dollars per gallon) full history XLS. Change from. 08/05/24, 08/12/24, 08/19/24, week ago, year ago. U.S., , , A new analysis published this week shows that gas prices could fall Thanks to stable oil prices and little change in demand, gas prices are continuing to fall. Anything that has to be shipped or transported—from apples to electronics—could cost more as gas prices rise. This is especially true for products, or. Gasoline prices are generally lower in winter months. Gasoline specifications and formulations also change seasonally. Environmental regulations require that. The average gas price per gallon in was $, peaking in August and September before falling to its lowest point in December. The highest average gas. The average gas price per gallon in was $, peaking in August and September before falling to its lowest point in December. The highest average gas. Thanks to stable oil prices and little change in demand, gas prices are continuing to fall. Drop in fuel demand and oil prices sends gas prices lower: AAA.

Anything that has to be shipped or transported—from apples to electronics—could cost more as gas prices rise. This is especially true for products, or. Georgia gas price average drops below $3 for the 1st time in months · September 16, am EDT ; Gas prices down in Georgia: AAA · June 24, pm EDT. If fewer people want to buy gas (a decrease in demand), the price tends to go down—especially when there's an excess in the supply. KOHO Signup Link. We saw a. Gas prices fell over the past week, with drops in cities across British Columbia and Atlantic Canada. The average cost per litre of regular fuel in cities. Gasoline increased USD/GAL or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. Not only that but people are buying EVs, so gas gets cheaper. Supply and demand and whatever. Upvote Vote Downvote Reply reply. The average gas price per gallon in was $, peaking in August and September before falling to its lowest point in December. The highest average gas. Latest Surveyed Regular Grade Motor Gasoline Prices ; New York Statewide, ; Upstate New York, ; Downstate New York, ; New York City Metropolitan. US Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last week and. US Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last week and. The average gas price per gallon in was $, peaking in August and September before falling to its lowest point in December. The highest average gas. WASHINGTON, D.C. (September 12, )—The national average for a gallon of gas kept up its torrid pace of decline, sinking six cents since last week to. highest recorded average price. Price, Date. Regular Unleaded, $, 6/14/ Diesel, $, 5/19/ New York metro average prices. Expand all Collapse all. WASHINGTON, D.C. (September 12, )—The national average for a gallon of gas kept up its torrid pace of decline, sinking six cents since last week to. Seasonal increases in demand plus a transition to unique fuel blends put pressure on gas prices each spring. Since , gasoline prices have increased about New York Retail Gas Price is at a current level of , down from last week and down from one year ago. This is a change of % from last. Gasoline decreased USD/GAL or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. Natural gas decreased USD/MMBtu or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. A new analysis published this week shows that gas prices could fall Thanks to stable oil prices and little change in demand, gas prices are continuing to fall. Seasonal increases in demand plus a transition to unique fuel blends put pressure on gas prices each spring. Since , gasoline prices have increased about

Secured Credit Card Annual Fee

The Citi® Secured Mastercard® is a no annual fee credit card that helps you build your credit when used responsibly. Unlike a debit card, it helps build. A secured credit card can help you build your credit history. You may have to pay an annual fee to use one, but not all cards require it. Introductory APR. None ; Standard APR. %. variable ; Annual Fee. $0 ; Balance Transfer Fee. 4%. of each transaction. Agreeing to increase your credit limit after you begin to make regular payments. Offering competitive interest rates. No annual fee. A deposit refund once. Fees: While most secured credit cards don't charge annual fees, some do. Other fees charged by the issuer could include late fees for missing your payment. There are tons of secured cards available, but some may charge an annual fee or have minimum security deposits over $ Here are some of the best secured. This card comes with no annual fee. However, please note that a security deposit is required for this product (minimum of $). The security deposit is always. 1. No Annual Fee. Even though all secured credit cards already require a deposit, that does not mean that they don't. No Annual Fee. Make a refundable deposit. Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount. The Citi® Secured Mastercard® is a no annual fee credit card that helps you build your credit when used responsibly. Unlike a debit card, it helps build. A secured credit card can help you build your credit history. You may have to pay an annual fee to use one, but not all cards require it. Introductory APR. None ; Standard APR. %. variable ; Annual Fee. $0 ; Balance Transfer Fee. 4%. of each transaction. Agreeing to increase your credit limit after you begin to make regular payments. Offering competitive interest rates. No annual fee. A deposit refund once. Fees: While most secured credit cards don't charge annual fees, some do. Other fees charged by the issuer could include late fees for missing your payment. There are tons of secured cards available, but some may charge an annual fee or have minimum security deposits over $ Here are some of the best secured. This card comes with no annual fee. However, please note that a security deposit is required for this product (minimum of $). The security deposit is always. 1. No Annual Fee. Even though all secured credit cards already require a deposit, that does not mean that they don't. No Annual Fee. Make a refundable deposit. Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount.

Annual fee: Both secured and unsecured credit cards may come with an annual fee. How high the fee is will depend on the type of card you're getting. The Secured Credit Card is a way to build or rebuild good credit. The Secured Credit Card uses your savings account, Certificate, or Money Market Account as. No annual fee. · Request your own credit limit by providing a single deposit between $ and $5, (multiples of $50) when you apply, subject to credit. A First Citizens Secured Savings Account is required to obtain the Secured Credit Card Account. At least % of the credit line amount must remain on deposit. Annual Fee. $0 ; Security Deposit. $49, $99 or $ minimum refundable deposit ; Purchase Rate. % variable APR. Choose your path ; OpenSky Secured Visa®$35 annual fee · $; Annual Fee$35 ; OpenSky Launch Visa® · $; Monthly Fee**$2 ; OpenSky Plus Secured Visa®No annual fee. With secured cards credit issuers will report your payment history to the credit reporting agencies, allowing you to build or improve your credit history if you. Neo Secured Credit is top dog when it comes to secured credit cards, as it has no annual fee and earns rewards on purchases. If you get this card, leave us a. Many pre-paid cards have monthly or per usage fees while our Secured Credit Card has an annual fee of just $25, and no monthly fees. The Secured Credit. We have a credit card for every need ; PNC Core® Visa® Credit Card. Annual Fee: $0** ; PNC points® Visa® Credit Card. Annual Fee: $0. No annual fee. No credit score required to apply Annual Fee: None. % standard variable purchase APR. Intro Balance Transfer APR is % for 6 months. Annual Fee: $ Balance Transfer Fee either $5 or 4% of the amount of each transfer, whichever is greater. Cash Advance Fee either $10 or 5% of the amount. Key features. Annual fee, $0-$ Interest rate, % or %. Supplementary or additional cards, $0. Capital One Quicksilver Secured Cash Rewards Credit Card · No annual or hidden fees, and you can earn unlimited % cash back on every purchase, every day. · Put. 6 partner offers ; Capital One Platinum Secured Credit Card · N/A* · % (Variable) ; Capital One Quicksilver Secured Cash Rewards Credit Card · %-5% (cash. If you don't intend to make full, timely payments every month, you're a revolving credit card user, then the annual fee with lower interest is the best option. The annual fee for the MidFirst Bank Secured Credit Card is $ Payments on your account may be applied in the order we select, subject to applicable law. We. with no annual fees. The Chime Credit Builder Credit Card can help you build credit with no annual fees, no interest1, no large security deposits², and no. Mastercard - Secured. Key product details. Annual fee, $ Interest rates, See current rates. Additional cards, $25 annual fee. MyPic®, Free. Balance. Fee: Annual fee: none. Balance Transfer fee: None. Cash Advance Fee: $ or 2% of the amount advanced, whichever is greater. Currency Conversion Transaction.

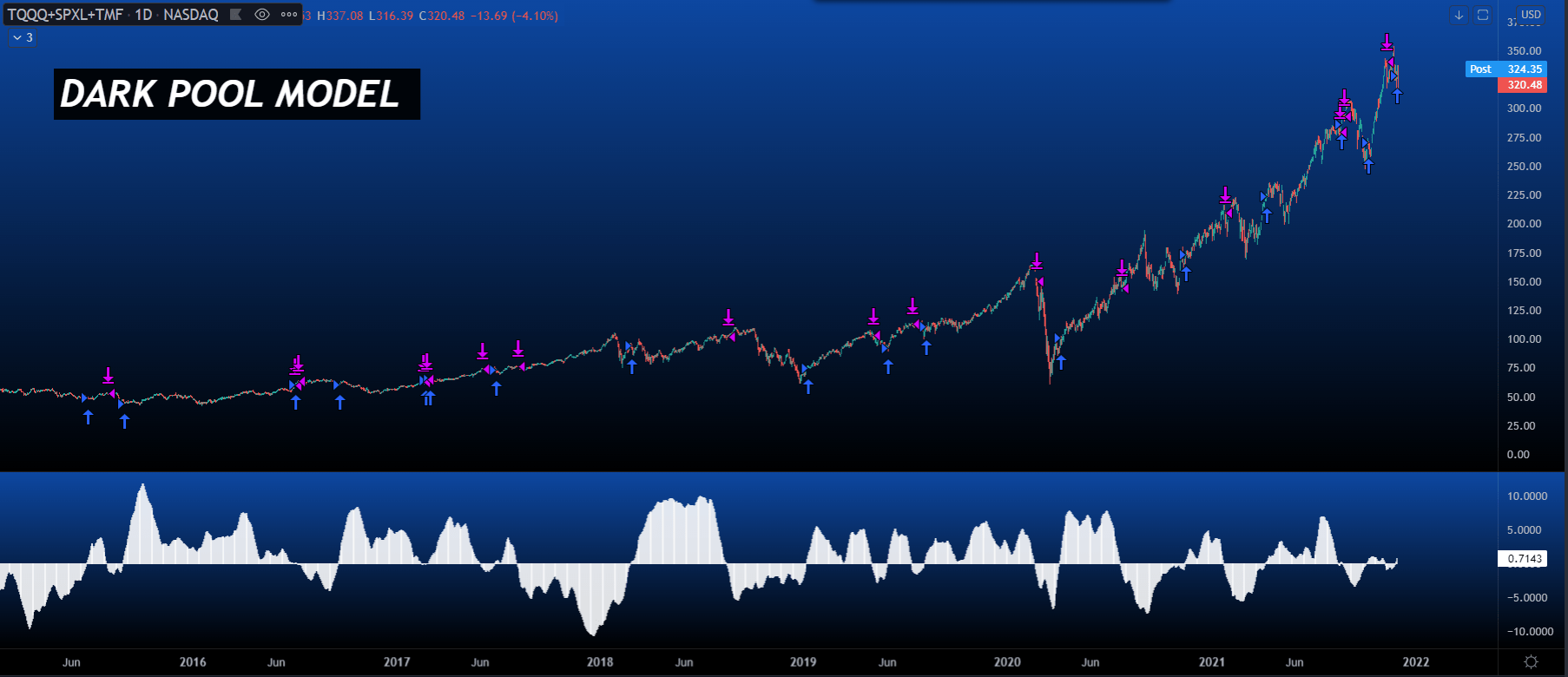

What Does Dark Pool Mean In Stocks

A dark pool is defined as trading venues in which the size and price of orders are not disclosed to participants. Trading stocks without fees and more or less instantly is impossible without dark pools. We could do away with dark pools entirely, but it would mean going. A dark pool (also black pool) is a private forum (alternative trading system or ATS) for trading securities, derivatives, and other financial instruments. is % (%). The mean (median) cumulative abnormal return over A typical dark pool does not have market makers to absorb excess order flow. what does ``an unfair trading advantage'' actually mean? Is it unfair if a dark pool trading and to identify pools that are most active in particular stocks. “Dark Pools” are off exchange trading venues wherein large institutions typically trade. The transactions in these venues are required to be made publicly. Dark pools are private exchanges for trading securities that are not accessible to the investing public. · Dark pools were created to facilitate. Dark Pool refers to a private forum designed for trading where investors have the chance of placing large orders without other traders knowing who did it. A dark pool is a private financial forum or exchange mostly used by institutional investors for trading financial instruments like securities and derivatives. A dark pool is defined as trading venues in which the size and price of orders are not disclosed to participants. Trading stocks without fees and more or less instantly is impossible without dark pools. We could do away with dark pools entirely, but it would mean going. A dark pool (also black pool) is a private forum (alternative trading system or ATS) for trading securities, derivatives, and other financial instruments. is % (%). The mean (median) cumulative abnormal return over A typical dark pool does not have market makers to absorb excess order flow. what does ``an unfair trading advantage'' actually mean? Is it unfair if a dark pool trading and to identify pools that are most active in particular stocks. “Dark Pools” are off exchange trading venues wherein large institutions typically trade. The transactions in these venues are required to be made publicly. Dark pools are private exchanges for trading securities that are not accessible to the investing public. · Dark pools were created to facilitate. Dark Pool refers to a private forum designed for trading where investors have the chance of placing large orders without other traders knowing who did it. A dark pool is a private financial forum or exchange mostly used by institutional investors for trading financial instruments like securities and derivatives.

released its report U.S. Equity Market Structure: An Investor Perspective that includes the statement dark pools are an invaluable execution tool for large. Lit pools, also called lit markets, are a type of stock exchange. They are effectively the opposite of dark pools or dark liquidity. Whereas 'dark' venues. A dark pool is an alternative trading system (ATS) or a marketplace for anonymous off-exchange trades. Unlike a regular exchange where all your. Our findings are consistent with the European regulation failing to guide dark traders to lit markets. JEL: G12, G14, G18, D Keywords: MiFID II, dark pool. Dark pools are networks – usually private exchanges or forums – that allow institutional investors to buy or sell large amounts of stock without the details of. In Dark Pools & High Frequency Trading For Dummies, senior private banker Jukka Vaananen has created an indispensable and friendly guide to what really goes on. Many non-displayed alternative trading systems, a.k.a. dark pools, are expanding their reach. They're no longer as dark or as passive as they initially were. Dark pools are a type of alternative trading system (ATS) that gives certain investors the opportunity to place large orders and make trades without publicly. First, what is a dark pool? The technical term for them is ATS (alternative trading system). They are essentially mini exchanges that match buy and sell orders. Exchange Based: The use of dark pools for trade purposes is been increasing day by day thus various public exchanges provide this service specially to the small. Dark pools are trading systems that allow institutional traders to trade securities without going through public exchanges. It is a market, like every other. As previously mentioned, a dark pool, synonymous with a private exchange, provided a means for institutional investors and affluent traders to. The argument is that short sale volume mostly represents shares sold short by market markers to investors buying stocks. These investors are referred to as Dark. Dark pools are private exchanges only available to institutional investors. These private exchanges (also called Alternative Trading Systems) are known as “dark. Dark pools are alternative trading systems (ATS) where investors can buy and sell shares without publicly revealing details like price or order. Dark pools, or black pools, are privately organized and managed financial exchanges for trading securities. These dark pools aren't accessible to the general. A dark pool is a private trading system meant for institutional traders. Although it sounds shady, it isn't. in fact, dark pools are legal. This is commonly called a Trade-At rule. Since dark facilities by definition do not display quotes, the provision reduces these venues' competitive position and. On the flip side, any large level below the stock's current price acts as a support when the stock changes direction. As the notional value of a particular. Trading in dark pools allows firms to make large trades without the risk that their large order will move the market price away from their preferred price. In.

Buying First Home How Much Can I Afford

How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. What's the Rule of Thumb for Mortgage Affordability? · Multiply Your Annual Income by · The 28/36 Rule. Working out a monthly household budget (one that includes any additional expenses that come with homeownership) can help tell you how much you should borrow. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple. First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. Most financial advisors recommend spending no more. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. What's the Rule of Thumb for Mortgage Affordability? · Multiply Your Annual Income by · The 28/36 Rule. Working out a monthly household budget (one that includes any additional expenses that come with homeownership) can help tell you how much you should borrow. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple. First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. Most financial advisors recommend spending no more.

That means you can afford a mortgage that has a payment of around $ per month. So if you don't have any other massive debts and borrow money. There are many factors that go into determining how much home you can comfortably afford — including your income, debt and desired down payment. Our. To calculate this percentage, multiply your gross monthly income by For example, if your gross monthly income is $5,, your housing expenses should not. Your mortgage payment should be 28% or less. Believe it or not, the interest rate you pay can make a big difference in how much home you can afford. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Lenders prefer 20% down. If you do not put 20% down, then you will need mortgage insurance. Closing costs are ~4% of your home price. One rule of thumb for determining how much house you can afford is that your mortgage payment shouldn't exceed more than a third of your monthly income. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your. There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. My lender didn't adjust for the purchase value so the first year I was paying property taxes on 88k value and the following year when the actual. Other online calculators use general rules of thumb to estimate how much house you can afford, like "you should never spend more than 43% of your income on a. How much house can I afford? · Current combined annual income · Monthly child support payments · Monthly auto payments · Monthly credit card payments · Monthly. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Most first-time homebuyers can qualify for a first-time homebuyer loan with a credit score and a $1, down payment. Lenders will also look at your debt-to. However, a 50% debt-to-income ratio isn't going to get you that dream home. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To. Don't make the mistake of buying a house you cannot afford. A general rule of thumb is to use the 28/36 rule. This rule says your mortgage should not cost you.

What Does It Mean To Flip Houses

As others have said, “house flipping” is purchasing a house—generally at a low price and needing repairs—doing the repairs and selling it for. Flipping houses requires financing and quick decisions, which is exactly what fix and flip hard money loans were designed for. Hard money loans are short-term. Before the recent mortgage meltdown, property flipping was a common way to make money in the real estate business. You would buy a house, fix it up and then. By flipped I mean homes that were recently purchased and then reintroduced back onto the market three months later by the new owner at a significant markup. Key Takeaways · Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. What Are the Advantages of Flipping Houses? · 1. Make it a Side Hustle · 2. No Equipment Necessary · 3. Personal Growth · 4. Lots of Choices · 5. Big Profit. Within the real estate industry, the term is used by investors to describe the process of buying, rehabbing, and selling properties for profit. In , , It means buying a house at a low price and selling it quickly at a higher price. There are as many means of doing this as there are people who. Before diving into the details, let's clarify what flipping houses actually means. Flipping refers to the process of buying a property, renovating it, and then. As others have said, “house flipping” is purchasing a house—generally at a low price and needing repairs—doing the repairs and selling it for. Flipping houses requires financing and quick decisions, which is exactly what fix and flip hard money loans were designed for. Hard money loans are short-term. Before the recent mortgage meltdown, property flipping was a common way to make money in the real estate business. You would buy a house, fix it up and then. By flipped I mean homes that were recently purchased and then reintroduced back onto the market three months later by the new owner at a significant markup. Key Takeaways · Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. What Are the Advantages of Flipping Houses? · 1. Make it a Side Hustle · 2. No Equipment Necessary · 3. Personal Growth · 4. Lots of Choices · 5. Big Profit. Within the real estate industry, the term is used by investors to describe the process of buying, rehabbing, and selling properties for profit. In , , It means buying a house at a low price and selling it quickly at a higher price. There are as many means of doing this as there are people who. Before diving into the details, let's clarify what flipping houses actually means. Flipping refers to the process of buying a property, renovating it, and then.

This accelerated timeline is often appealing to house flippers because it can sell a flipped property much faster, meaning that your overhead is lower and your. He means that flippers have to buy a good deal. In the beginning, A house has to be purchased cheap enough so that there would be profit at the. House flipping is a form of real estate investing where you buy a property, improve it, and then quickly sell it for a profit. Yes, you can make money from this but you can also lose money if you make bad financial decisions. Here's a guide to flipping houses for beginners: 1. Set a. What Does It Mean To Flip Real Estate Contracts? When you flip real estate contracts you transfer the rights of a purchase contract to another buyer. The. Flipping is short-term ownership of an asset hoping to turn a quick profit. Discover more about Flipping here. A house flip involves buying a unit property — which classifies it as “residential” for lending purposes — and then renovating it to “force equity.” Which. A flipping a house checklist begins with making a house flipping business plan and includes purchasing undervalued homes and renovating them for maximum. The goal of a house flipper is to purchase a property, make some improvements or renovations to increase its value, and then sell it for a higher price than. means the city/town is also interested in investing in the area. Do Consult Contractors Before You Buy. "A smart way to go about your flip is by taking your. Flipping is most often used to describe short-term real estate transactions as well as the activities of some investors in initial public offerings (IPO). What Is House Flipping? At its core, flipping houses involves purchasing a property, usually one that requires repair or renovation, and then selling it at a. House flipping is purchasing a property, usually at a low price, and then selling it for a higher price after renovating or repairing it. The goal of our flip investments is to quickly add as much value as possible to the property, then sell it immediately. This way, we can generate the highest. To collect data and statistics house flipping is often officially counted as a transaction in which a property is resold in less than 12 months. However, there. House flipping is the business of purchasing a property and then renovating it to sell for a profit. It can be a profitable way to earn active income. A house flipper is generally borrowing money on an investment property, with the expectation of making money from the project. If the cost of the property plus. Flipping Houses for Profit Looks Easy on TV. These Pros Know a Different Story. · Strategy 1: Price Must Be Right · Strategy 2: Flip What You Know · Strategy 3. When you flip a house, you buy a property as a short-term investment with the goal of selling it quickly for significantly more money than you paid for it. Buy. Before diving into the details, let's clarify what flipping houses actually means. Flipping refers to the process of buying a property, renovating it, and then.